According to the NextŽeny analysis, the transfer of property to women, a trend observed abroad for a long time, is also starting to unfold in Czechia and Slovakia and is likely to continue in the coming years. For many women, the management and efficient use of their own assets is currently, or will soon be, a major challenge. This is why we believe that the issue of women’s ownership and succession is crucial.

Women and their property worldwide

Women are an increasingly important economic force. A survey by the Boston Consulting Group (BCG) reports that in recent years, women’s wealth has been globally growing at a record pace – by USD 5 trillion annually. While in 2020 women controlled 33% of the total global investable personal assets, this share is projected to increase to 35% by 2025.

Economic potential

If women continue to have opportunities to contribute to the economic growth and prosperity of society, exploiting their work potential in full, and if gender inequalities in the workplace are reduced, the GDP of advanced economies might increase by around 6% within one to two decades, according to a study by Citibank. A McKinsey & Company analysis conducted in 2021 says that better use of women’s economic potential might increase the Czech and Slovak GDPs by around 8% by 2030.

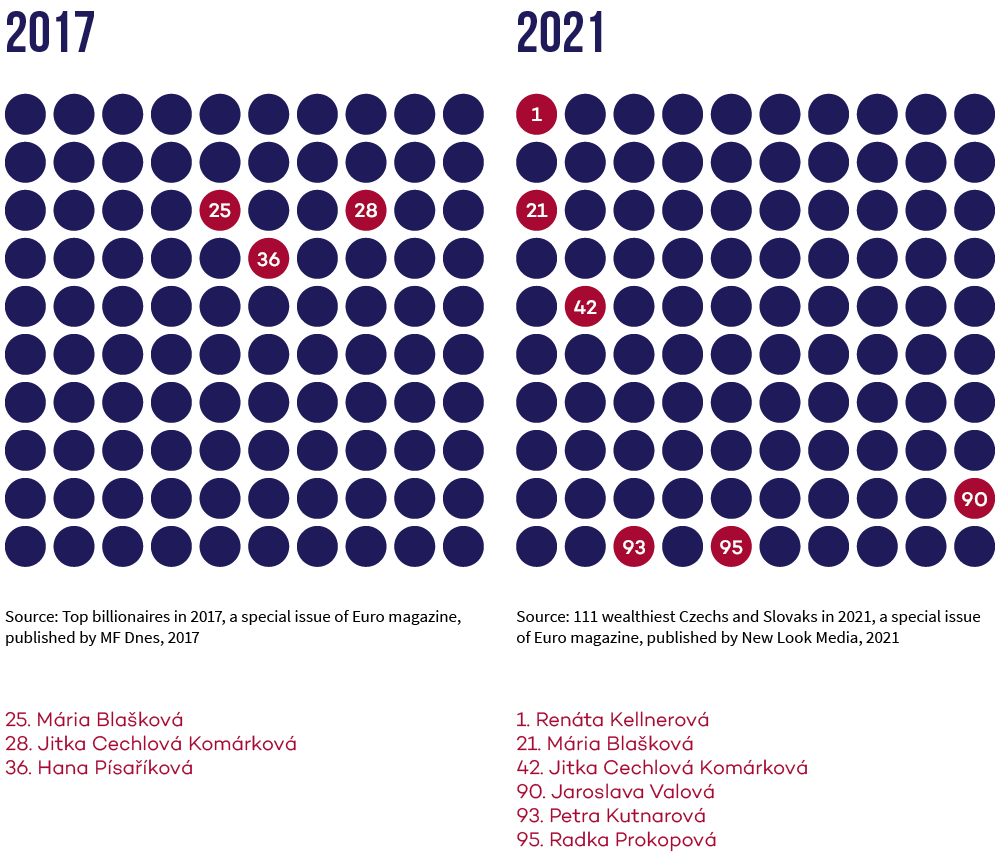

The wealthiest women

The number of rich women in Czechia is growing. In a ranking compiled by Euro magazine, the number of women in the top 100 richest people in Czechia in 2021 has doubled compared to 2017, from three to six women. The value of women’s assets in these rankings has also increased substantially. While in 2017, women in the top 100 richest people in Czechia held assets worth nearly CZK 30.5 billion, in 2021 it was almost ten times more – CZK 290 billion.

Education is essential to a career

Higher education means a better chance of career advancement. According to the Czech Statistical Office’s data, the number of women with a university degree has been rising over the past 30 years. Since 2014, women with a university degree have outnumbered university-educated men. According to statistical predictions, 1,140,000 women will have finished their university in Czechia by 2030. By contrast, 2030 is expected to see 17% – or 190,000 – fewer equally educated men.

Women in the lead

According to an analysis by SC&C, a research agency, in 2021 the number of economically active women increased overall. In addition, the absolute number of female managers has been growing, too. 35.6% of women held senior positions in the private sector in 2021, i.e. CEOs, chairpersons, presidents and board members. Within the economically active population, the number of women in top positions increased by 3% since 2015 (2015: 35,500, 2021: 36,500) and might increase by a further 3% by 2030, according to SC&C.

Enterprising women

The number of women with trade licences is also growing in Czechia. In the last five years, there have been 7% more, exceeding 750,000 in total. By 2030, SC&C estimates that this number might increase approximately by another 11%, to more than 850,000. Women are also improving their economic status through pay increases. Even though still wide, the gender pay gap has been narrowing in recent years. Compared with 2011, men’s median pay was up by 52% in 2021, while women's median pay increased at a greater pace of 62% over the same period. So, in fact, women are improving their situation, and their pay growth rate is slightly higher than that of men.

Female investors

International studies point out that women and men take a different approach to financial and wealth management. Women are not inclined towards risky investments, preferring more conservative capital protection and managing their assets through passive investment strategies. They make long-term investments in line with their goals and beliefs. In their investments, they tend to consider environmental, social and governance aspects. In Czechia and Slovakia, however, no research has yet taken a more comprehensive look at the specific approach of women and men to property ownership and management. That is why in 2023 the initial NextŽeny survey will be followed by a study in Czechia and Slovakia focusing on women’s and men’s tendencies and decision-making processes directly related to the management of their assets.

Living longer

Demographics have a significant impact on the transfer of wealth to women. The Czech Statistical Office’s data show that women in the Czech Republic are living increasingly longer lives, outliving men by an average of 6 years. In 2030 they are projected to live 7 years longer than men. Wives are on average 2 years younger than their husbands, a phenomenon further widening the gap in life expectancy between the partners. As a result, after the husband’s or the male partner’s death, the property is likely to pass on their spouse. In addition to inheritance from the husband, women also inherit property and money from their parents.

Inheritance

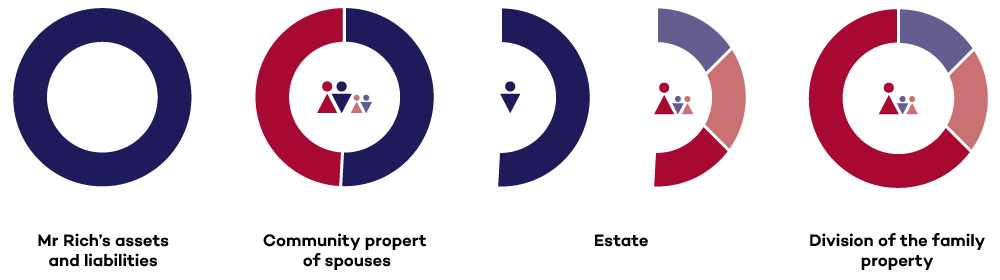

Death and inheritance are major life milestones that involve a one-off transfer of a significant amount of wealth. If there is no testament or contract of inheritance and the spouses have no provision for the division of property, the estate is settled under the statutory rules. In most cases, the property passes to heirs of the first degree, i.e. spouses and children. The heirs of the first degree receive an equal share of the estate. If the deceased was married, the community property is first settled between the spouses, and only the part of the property solely owned by the deceased is included in the inheritance.

Inheritance procedure

What is the procedure in the case of intestacy? Let us take the Rich family as an example. Being a typical couple in terms of age, Mr Rich has a wife 2 years younger than him and 2 children (a daughter and a son). On the assumption that men die younger than women, Mr Rich will probably die 8-9 years before his wife. He and his wife did not sign either a pre-nuptial agreement or an agreement to regulate their community property, and neither did they make any testament. Upon the death of Mr Rich, the community property would first be divided in half. His wife would be left with her half and the other half belonging to Mr Rich would then be settled as the estate, divided equally between Mrs Rich and each of the children. As a result, 4/6 of the property will go to Mrs Rich, 1/6 to the son and 1/6 to the daughter.

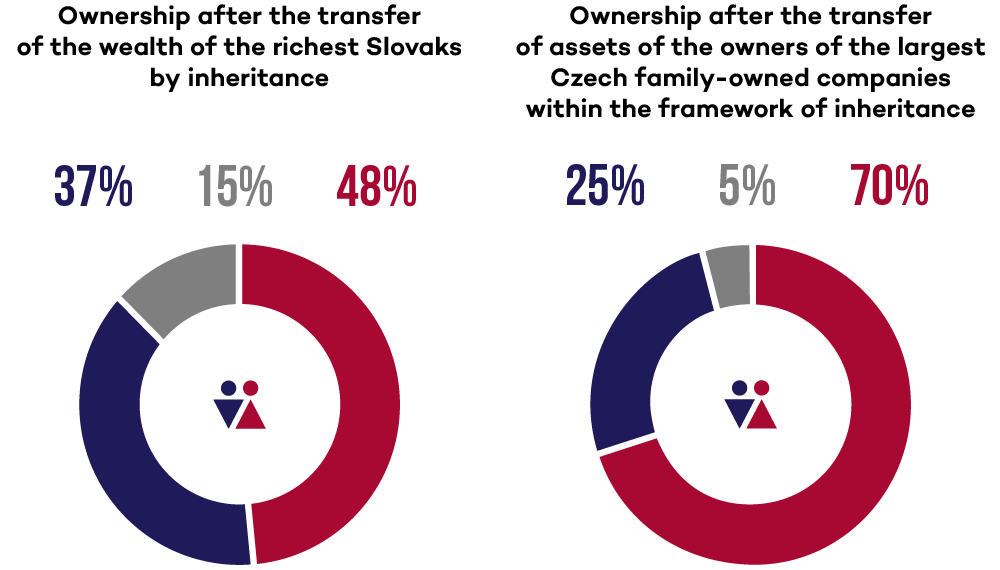

Female succession

Looking closer at the largest family firms’ owners and the wealthiest Czechs and Slovaks in the case of intestacy, a study explores whether the transfer of wealth to women will be relevant in Czechia and Slovakia in the coming years. The HAVEL & PARTNERS team specialised in services to private clients prepared a detailed analysis of their property and family circumstances. The experts modelled a sudden transfer of assets from one generation to the next if the statutory rules were applied. Currently, men nominally own most assets, but the model of wealth transfer in the event of intestacy showed that in the future, between 48% and 70% of wealth might be transferred to women in the target group observed. Although these figures are only indicative of specific limited groups and only consider the transfer of property under the statutory law, the results suggest that women should be regarded as potential successors to the current owners.