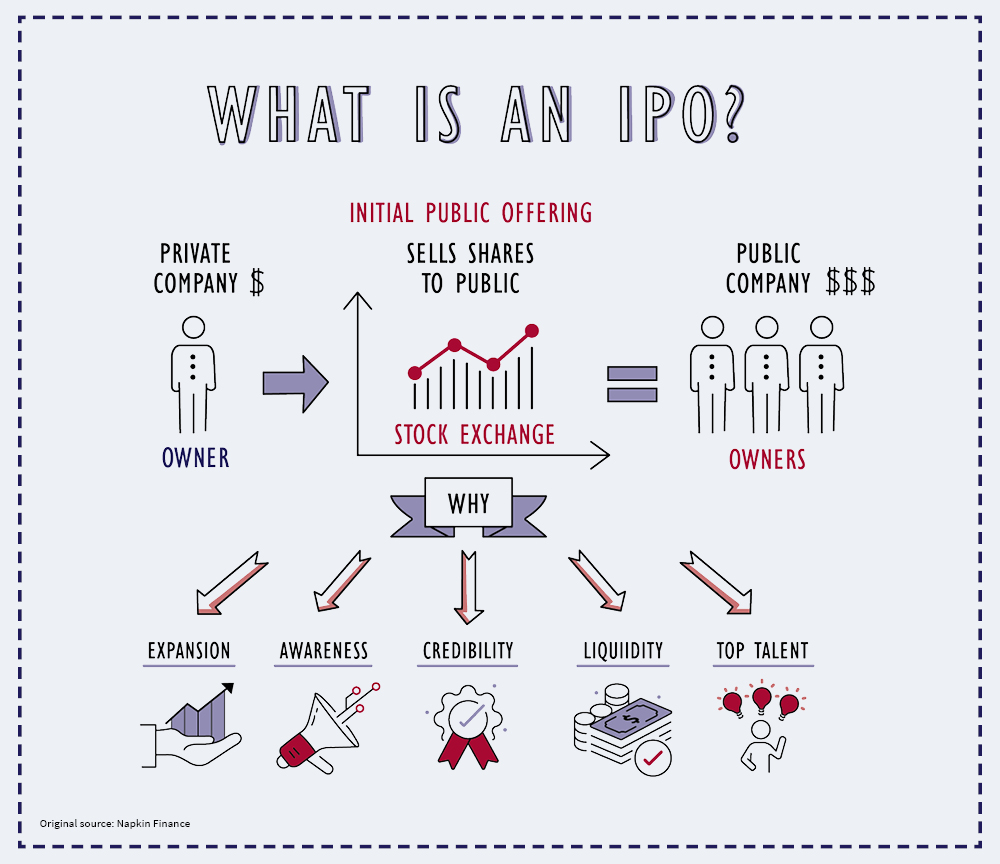

An initial public offering (IPO) is a way to raise capital for further business development. A company listed on the stock exchange is automatically more credible and has prestige in the eyes of the public, investors, customers and suppliers. This is true in the local market and especially abroad.

The abbreviation IPO stands for Initial Public Offering. The company increases its capital and offers new shares to the public, which are then traded on the stock exchange. The company is not going into debt but is offering an investment to new shareholders.

The existing shareholders usually retain a majority shareholding so that they can continue to control the company but share the profits with the new shareholders. A combination of new capital and the exit of existing shareholders is also possible. The stock exchange then allows investors to trade the shares on an ongoing basis, thus showing the market value of the company.

The market for initial public offerings (IPOs) has been really “hot” until recently. The year 2021 was also a record year due to the deferred transactions from the covid period and the optimism of overcoming it, which was also reflected in the valuations achieved. Globally, firms raised USD 608 billion through IPOs, with the USA being the dominant region.

In 2022, although the very volatile markets cooled down as investors were more cautious and did not buy everything labelled "IPO", they were still prepared to invest in interesting titles. However, they are now focusing much more on the fundamentals of companies, i.e., their valuation based on profits and free cash flow.

IPO is financing

The aim of the IPO is to raise capital for further development – investments, acquisitions or expansion of the company on local and foreign markets. You optimize your balance sheet, reduce your debt ratio or increase your debt capacity, and equity risk is spread across a wider pool of investors. It is new capital for the company, so you are not restricted by maturity or limits as with loan agreements or bonds.

The big advantage of an IPO is the freedom to use capital – you are not restricted by maturity or limits as with loan agreements or bonds

An IPO usually brings other benefits as well – in addition to access to capital, it is also an effective way of maintaining control of the company despite the reduction of the original shareholders' shareholding. Due to their fragmented structure and their typically passive nature, new investors generally do not have a significant influence on the decision-making process. Trading shares on the market may also promote liquidity in the case of a future exit of some shareholders.

Success on the stock exchange also always entails a significant positive marketing and PR effect, which contributes significantly to increasing the prestige and credibility of the brand. The very fact that your company is "listed" often opens doors to suppliers, customers, and business partners.

Where to offer?

One of the fundamental decisions when preparing an IPO is choosing the right market. There are three types of markets on offer, each suitable for a different volume of financing and type of investor.

In recent years, the PX START market organized by the Prague Stock Exchange has become popular among smaller and medium-sized Czech and Slovak companies. Issues here range from CZK 50 million to CZK 1 billion. The conditions for admission are relatively simple; the stock exchange itself is very accommodating to issues, and the market conditions to date have also been favourable to share issues. In total, more than a dozen companies are already on the START market. Investors are usually from the retail sector, but especially in larger issues, institutional investors (funds, insurance companies, etc.) also buy.

Larger issues can then be placed on the main market of the Prague Stock Exchange. Billions of crowns are issued on this market, and mainly larger institutional investors from the CEE region invest in it. However, it is a regulated market, which means stricter conditions for listing. Here the IPO is particularly suitable for larger companies with a focus on the EU or Central European market.

If you have a company with ambitions to succeed on international markets, then a listing on one of the foreign stock exchanges, for example in Amsterdam, London or New York, may be a good way to go. Compared to the local market, their investments in shares are in higher orders, i.e., in the tens of billions of crowns. Investments here are mainly made by large international investors, which is why it is necessary that the company in which they are to invest their funds is internationally known and has a product with transnational or global potential.

The fact that Czech investors have long since crossed the borders of local markets is confirmed by the success of the Czech-Slovak venture capital fund Credo Ventures in 2021, when the Romanian start-up UiPath achieved historic success with its listing on the New York Stock Exchange. UiPath is one of the fastest growing software companies in its segment in the world today and has had one of the largest IPOs in its category on the New York Stock Exchange.

A good growth story is the key to success

When considering an IPO as a financing option, you need to consider your preferences and goals. If you need capital for further development, expansion, or acquisitions, you can't or don't want to take on further debt from banks or bond issues, and the company has a clear growth vision for the future with you, then an IPO could be what will move your business forward. But if you are thinking of selling the company and taking a well-deserved rest, an IPO is not the way to go.

In an IPO, investors are buying the future of your company. Therefore, your growth story (called the equity story) will be crucial to the success of selling the company's stock. It should therefore be reasonably ambitious, but believable, and interesting to the investor. If you can back it up with decent historical results, so much the better.

Investors will become your (co)shareholders and therefore need information. Such information needs to be prepared and presented. So before the transaction itself, it is necessary to do your homework – get your data, accounting and reporting in order, find and sweep the skeletons out of the closets, find and motivate the internal team. These are all major factors in successful preparation.

How to do it

At the beginning, we recommend setting up a team to be in charge of the entire transaction. The key people in the company are the CFO and the existing shareholders. Also important will be people in the role of investor relations management who are responsible for proper communication. Of the advisers, an investment bank or adviser is essential to arrange the entire transaction, value the company, help set the right business parameters for the IPO, and then offer the shares to investors. Lawyers who should have already handled an IPO transaction are also essential.

Prior to actually going public, detailed due diligence of the company takes place. The company provides data, ongoing communication with lawyers takes place, and any issues discovered are resolved. Due diligence allows you to uncover remaining skeletons, legal defects or other obstacles that could complicate the transaction.

A prospectus is prepared in parallel with the due diligence. This is a basic information document for investors – it describes the issuer of the shares, its business, market trends and risks, as well as the IPO itself. It must also include audited accounts for at least the last 2 years. The prospectus is written by lawyers in cooperation with the issuer and the investment bank and is approved by the Czech National Bank (or, in the case of foreign issues, by the local regulator). Only after the prospectus is published can the shares be offered.

The IPO then usually lasts 2–3 weeks, when a roadshow takes place, i.e., intensive meetings with investors and presenting the equity story (a charismatic shareholder or CFO is always an advantage). All this is complemented by an information campaign on the web, investment portals or in the media.

Depending on the results of the IPO, the company will then determine by how much it will increase its capital (or how many shares will be sold by existing shareholders), and the lawyers will arrange the necessary corporate action. When the company goes public, the investors will ultimately pay the subscription price, and the company will issue them new shares. These will start to be traded on the stock exchange.

The preparation of the transaction, from the first considerations through strategic issues and fine-tuning details, to the actual implementation, is a process that usually takes 6–12 months on the PX START market, but 1–2 years for large companies heading to a "big" stock exchange or foreign market. The cost of going public is within a few percent of the total issue volume.

Life after the IPO

If the company performs well, its market value will grow. The investments of all shareholders (existing shareholders and new shareholders, often management or employees) will thus appreciate in value and the stock exchange will enable their liquidity.

In addition, a listed company also has a very open path to further financing, e.g., through a secondary follow-up offering of additional shares on the market or a "big" IPO on one of the larger and more prestigious markets.

After a successful IPO, the company's life changes. Shareholder and investor awareness is essential for successful stock market trading. So, for example, you need to expect to regularly publish the economic results – a detailed annual report, half-yearly reports, and sometimes a quarterly report. After the IPO, the company has hundreds or thousands of new shareholders, which usually increases the agenda of "big" general meetings.

In addition, all the company’s managers must report their transactions in the company shares to the Czech National Bank to prevent insider trading. To do this, it is necessary to monitor so-called inside information, work with it internally, publish the important parts and prepare for the possible increased interest of the public and the media. Therefore, reliable management of information flows within the company and the proper functioning of the investor relations department are essential.

Success factors

IPOs depend on investor demand, so no one can guarantee success in advance. However, if the company is well prepared, has an attractive equity story, does not exaggerate the valuation, and the market is positive, few transactions are unsuccessful. Therefore, in addition to careful preparation and selection of the appropriate market, proper targeting of investors and the corresponding communication and marketing are also essential.

The HAVEL & PARTNERS team has years of experience in the capital market; in the last 5 years we have completed the most IPO transactions on the Czech market. We provided comprehensive services to issuers and arrangers of securities in the issuance, public and non-public offering of bonds and shares and their listing on the Prague Stock Exchange market. We helped list the shares of Slovak hi-tech company Gevorkyan (the most successful transaction for CZK 730 million), Hardwario, FIXED.zone, eMan and Atom Trace on the Prague PX START market.