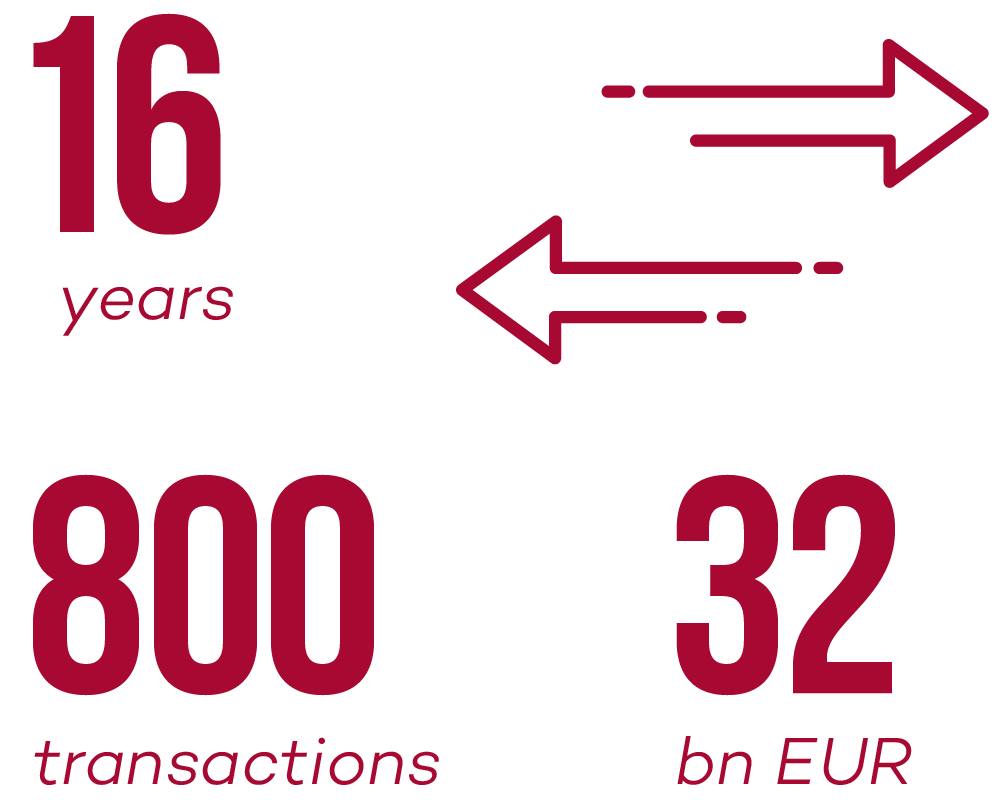

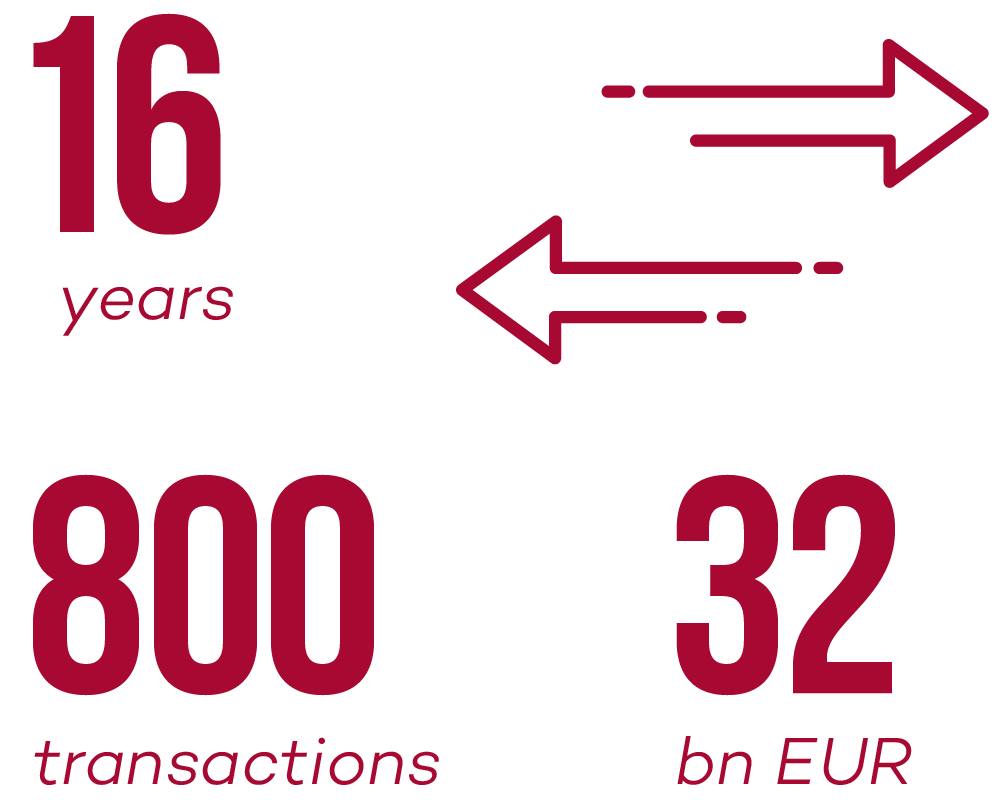

Over the past 16 years, we have been involved in completing over 800 transactions, not only in mergers, acquisitions, divestments, and restructurings. Their total value exceeds EUR 32 billion. Here is an overview of the major ones in the recent period.

Škoda auto

For ŠKODA AUTO, a Volkswagen Group company, we provided comprehensive legal services in resolving disputes over the ŠKODA trademark with engineering companies from the Škoda Group, which are part of the PPF Group.

The disputes that arose amoung all the companies were resolved by an agreement under which our client, the automotive company ŠKODA AUTO, became the owner of the ŠKODA trademarks worldwide. It is a significant step, building on the rich history of the brand, and important for the future development of this leading Czech company on local as well as global markets.

Our services included strategic legal advice and litigation services provided by a team led by partner Jan Šturm, intellectual property advisory services provided by a team led by partner Ivan Rámeš, and a team led by partner Jan Koval also provided comprehensive transactional advisory services.

LIGHTHOUSE VENTURES

The firm’s team led by partner Václav Audes assisted the investment fund Lighthouse Ventures in the sale of PEKAT VISION. This Brno-based start-up has developed innovative software that can automatically detect defects in products on the production line. With the help of artificial intelligence, it recognises a product that differs from the model. This unique technology helps companies improve and automate their production processes.

The buyer was the Italian company Datalogic. The sale of the company brought significant return on investment to Lighthouse Ventures.

Credo Ventures

Our venture capital specialists handled legal services for Credo Ventures in its investment in the start-up EquiLibre Technologies. M&A advisory services were provided by partner Václav Audes and senior associate Tomáš Navrátil, tax aspects were handled by partner Josef Žaloudek, and corporate, contract and employment law services were provided by senior associates Irena Munzarová, Radek Riedl and Vojtěch Katzer.

For Credo Ventures this was a very early stage investment in EquiLibre Technologies. The goal of this start-up is to develop a unique algorithm and artificial intelligence system to buy and sell assets on exchanges, which would identify suitable investments, especially in stocks and cryptocurrencies, before their value rises.

EUROPEAN HOUSING SERVICES

Our lawyers represented the real estate group European Housing Services (EHS), which invested in M&M Reality, one of the largest real estate companies on the Czech market. The transaction resulted in the formation of a real estate group of European significance.

Partner Petr Dohnal and senior associate Josef Bouchal were responsible for comprehensive legal advice to the client. The EHS Group, which includes the real estate agency MAXIMA REALITY, the server Bezrealitky in the Czech Republic and Slovakia, and the Czech Real Estate Trust, has previously invested in real estate auditors NEMO Report and the Ownest start-up. HAVEL & PARTNERS provided legal services to the EHS Group in these two transactions as well.

SLOVAK TELEKOM, POSAM

Our M&A experts advised PosAm, which is majority-owned by Slovak Telekom, the largest telecommunications operator on the Slovak market, on the sale of the Slovak company Commander Services. The newly rebranded Czech software company Seyfor (formerly known as Solitea), which is part of the Sanberg Capital portfolio, bought a 100% stake in Commander Services.

The Slovak company Commander Services focuses on car management software and since its establishment in 2005 has developed into a domestic leader in the field of vehicle monitoring via GPS and GSM technologies in the B2B segment.

The legal team that assisted the client in the sale of the company consisted of partner Ondřej Majer, counsel Petra Čorba Stark, senior associate Pavel Zahradníček, and associate Ivana Gajdošová.

OWNER OF SHARES IN KENTICO SOFTWARE

For the owner of Kentico software, Mr Petr Palas, we handled all legal services related to the sale of his minority stake in the company. The buyers were the U.K. fund Expedition Growth Capital and another private owner. The transaction was attended to by our M&A specialists – partner Jan Koval and senior associate Ivo Skolil.

The Brno-based IT company Kentico software is a strong player in the field of DXP (digital experience platform) and SaaS (Software as a Service) solutions. It offers products for the creation and management of corporate, information and product websites, e-shops and intranets, and effective tools for digital marketing and e-commerce. The company has tens of thousands of clients worldwide, including many Fortune 500 companies such as Volkswagen, Starbucks and Vodafone.

Euroventures

Our team acted as legal advisor to investors in a Series A investment round in which Daytrip, a Czech travel start-up, raised new capital totalling EUR 6.14 million. Daytrip is a global platform that offers tourists in 85 countries around the world private transportation with local drivers directly in the place they visit.

Partner Václav Audes, together with senior associate Josef Bouchal, provided comprehensive legal services related to the investment in Daytrip for the Budapest-based Euroventures fund, which led the investment round and invested its assets in the travel platform together with investors J&T Ventures, Nation 1 VC, and Pale Fire Capital.

ATMOS VENTURES, LIGHTHOUSE VENTURES A TERA VENTURES

Partner Václav Audes and associate Jan Krejčí participated as legal advisors to venture capital funds Atmos Ventures, Lighthouse Ventures and Tera Ventures in the investment round in logistics fintech 4Trans. It has also attracted private investors from Silicon Valley, and is thus aiming to become a leader in financing logistics companies.

4Trans provides financing for small and medium-sized companies in the logistics industry, which often face a lack of access to funding due to long invoice maturities. 4Trans solves this by factoring, i.e. immediately paying issued invoices, verifying customers’ payment habits, and offering other financial products.

PWC

We were instrumental in a major international advisory transaction – the sale of PricewaterhouseCoopers' (PwC) Global Mobility Tax and Immigration Services division to funds associated with Clayton, Dubilier & Rice. The acquisition resulted in the formation of Vialto Partners, a leading independent provider of cross-border employee mobility services.

In cooperation with London-based Linklaters LLP, our M&A specialists – partner Jan Koval and managing associate Silvie Király - provided comprehensive legal services to PwC in connection with the transaction in the Czech Republic, including related tax and employment aspects.

ZFP INVESTMENTS

Our team advised the buyer, the Czech company ZFP Investments, on the acquisition of the Blumental Offices project into its real estate fund. The office building, located in Bratislava on the boundary of the Old Town and offering 21,597 square metres of leasable area, was purchased by ZFP Investments from the Slovak developer CORWIN.

On behalf of our law firm, the buyer was advised by partners Lukáš Syrový and Ondřej Majer, and associate Peter Košecký.

This is one of this year’s largest transactions on the office market in the Slovak capital. The project’s strengths include a high level of environmental certification, LEED Gold. It is one of the most environmentally friendly buildings in Slovakia.

CENTENE CORPORATION

Our experts were involved in a major international transaction in the healthcare services sector. The M&A team advised Centene Corporation on the sale of Ribera Salud, a healthcare provider in Spain that operates hospitals and provides other healthcare services, including its subsidiary Pro Diagnostics Group (PDG), which owns healthcare facilities providing radiology and other services in Slovakia and the Czech Republic.

The transaction was handled by the Bratislava office team led by partner Václav Audes, counsel Petra Čorba Stark, and associate Ivana Gajdošová.

ORLEN UNIPETROL

We provided comprehensive competition law advice to the refining and petrochemical company ORLEN Unipetrol, representing the client before the Slovak Antimonopoly Office (PMU). Following a detailed analysis of the local markets, the PMU approved the acquisition of control by ORLEN Unipetrol over OLIVA petrol stations without any further conditions.

Our competition specialists, partner Lenka Gachová and legal expert Dušan Valent, were in charge of representing the company. Upon completion of this transaction, ORLEN Unipetrol will expand its activities in Slovakia, namely by a total of 39 petrol stations (existing and under construction).