On their wedding day, a couple vows (both to themselves and to each other) to live together happily ever after. But what happens after that, in case one of the spouses dies? The surviving partner must deal not only with a profound personal and emotional turmoil, but also with significant legal and financial changes.

By marrying, you confirm your shared love and dedication to be together for better, for worse, for richer, for poorer, in sickness and in health. At this moment, however, you also create the community property of spouses. It includes everything you (both or even just one spouse) have acquired during the marriage, with a few exceptions.

These exceptions include, for example, donated or inherited items. For instance, if the husband inherits a villa in a luxurious part of Prague from his aunt, this property does not count as community property. Furthermore, personal belongings (such as clothes, shoes and toiletries) or items one of you has acquired through a legal act related to their sole ownership (so-called transformation – typically when one spouse sells an item that they have inherited) are not included in the community property. Beware, however, that on the other hand, profits from the separate property of one spouse are part of the community property.

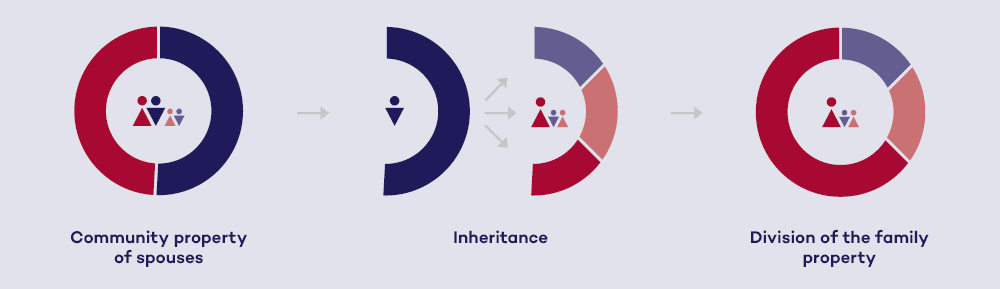

When a spouse passes away, the settlement of the community property of spouses is addressed first, followed by the distribution of the estate's assets among the heirs.

At first sight, this is a simple statutory definition. But in practice a number of problems arise regarding the community property of spouses and the application of these rules to specific situations. For example, the issue of the profit from the separate ownership of one of the spouses referred to above has not yet been reliably resolved by case law. It is therefore not certain whether the profit arising from, for example, the difference between the rent collected from an exclusively-owned flat and the costs incurred for that flat, is to be included in the community property (it would also be difficult to determine at what point in time the calculation should be made). It is not even certain whether the increase in the value of the exclusive property during the marriage or the active difference between the costs of acquiring the exclusive property and the amount obtained for its sale during the existence of the community property should become part of the community property. As a result, the mere determination of what is to be settled as community property poses a number of problems and practical difficulties, including in the event of succession proceedings.

First matrimonial property, then inheritance

Although it may sound a bit strange, the principle of community property is that you and your spouse both own the property value as a whole, mathematically speaking, its 100%. This is a fundamental difference from common property, where the co-owners must share the whole so that the sum of all shares adds up to 100%.

In the event of the death of one of the spouses, the priority in succession proceedings is first on the settlement of the community property, i.e. primarily what is part of the communityy property at all, and second on what part of the community property will belong to the surviving spouse and what part will be divided among the heirs. This is logical. The deceased spouse owned the entire community property, but the same applies to the surviving spouse.

The treatment of a deceased spouse’s assets and liabilities depends on two key factors: whether the spouses have modified or eliminated their community property in any way, and also whether the deceased spouse left a last will.

The inheritance of the Martins

The procedure can be practically illustrated by the simple case of the Martin family. Mr and Mrs Martin are married and have two children. They did not modify theirmatrimonial property regime in any way, nor did they make a will in case of death. Unfortunately, Mr Martin dies suddenly.

In such a case, the property will be settled solely under statutory rules. Let’s refrain from complicating the case with any potential obstacles, such as contributions from the exclusive property into the community property or vice versa, disparity of shares in the community property, or the exclusive property of Mr Martin, the community property will be divided in half in the first stage (community property settlement). As a result, the wife will receive half of the community property as part of the settlement, and the other half attributable to Mr Martin will be dealt with in the succession proceedings. The share will then be divided equally among the first class of heirs, which are the wife and children. As a result, Mrs Martin will receive 2/3 of the assets and each of the two children will receive 1/6 of the total.

However, in the event of the death of one of the spouses, we may encounter different variations of legal property situations or even combinations of variations. How the deceased spouse's assets are dealt with will be determined by several factors – the existence and terms of any community property modification agreement, as well as the disposition mortis cause (typically a testament) or other instructions regarding the treatment of their assets upon death.

For legal purposes, the spouses' living situation or relationship status at the time of one spouse's death is irrelevant. The very existence of the marriage and the form of the matrimonial property regime are fundamental. However, it is certainly easy to imagine that the quality of the spousal relationship will play a major role in the drafting of the testament.

Modification agreement and testament

As mentioned, community property can be modified during life by a modification agreement. The spouses may narrow or expand their community property in order to exclude or include selected specific or generic items, agree on a separate property regime (which effectively means that the community of property will not be created at all or will no longer exist in the future) or agree on a reservation of the creation of community property as of the date the marriage terminates. All of this also affects the settlement of the decedent’s estate.

In terms of succession law, spouses belong to the first and second classes of heirs. It is clear that the law provides spouses with one of the strongest positions in succession proceedings. However, it is the testament that can fundamentally change the initial position of the spouses. Without proper consideration and the necessary information, the testament may bring a result that was far from intended.

For example, if you do not want your testament to deal with the estate as a whole, but only with a part of it (such as immovable property), the subsequent succession proceedings proceed according to the classes of heirs and statutory rules as well as according to the decedent’s communicated will. In combination with the existence of matrimonial property (in a statutory or contractual but not cancelled regime), this is often a rather complicated matter, where dysfunctional “co-ownership communities” are created for real estate, leading to further disputes.

The decedent’s will, i.e. the instructions or wishes as to how the estate is to be dealt with, must be taken into account and respected in the succession proceedings. This can quite significantly complicate and limit the division of property among the heirs also in a situation where there is a consensus among them (if they have a different idea of the distribution of property than the decedent).

It is rather a paradox that the community property can come in handy in such a case. An agreement of the heirs with the surviving spouse (who may or may not also be one of the heirs) on the settlement of the community property is one of the possibilities (another one being a court’s decision in case of the non-existence of such agreement) to create some space in the agreement of the heirs upon the settlement of the estate.

Note that the settlement of community property is subject to general settlement rules under the Civil Code. Therefore, it cannot be excluded that even in the succession proceedings, for example, a disparity of shares in the community property will apply. Such disparity may be determined by agreement between the heirs and the surviving spouse that the deceased spouse's share in the matrimonial property is greater or less than 50%, and which specific assets are to be divided among the heirs at a later stage.

In this context, it should be noted that in contrast to the settlement of the community property during a divorce, the law does not allow the court to take into consideration the contributions from the exclusive property of one of the spouses to the community property when settling the community property in the succession proceedings.

Think ahead

It is therefore clear that although the law contains both rules for the range of community property and for its settlement in the event of its dissolution by death, it is also true that their application in specific cases may give rise to a number of uncertainties and problems.

These may arise not only if you as spouses have relied on endless love and a merely basic statutory regulation and you have not modified the matrimonial property in any way or even have not made a testament about your property, but also in the opposite case. In practice, we know of a number of cases of less-than-ideal formulations of modification agreements (typically narrowing the community property to exclude selected, generic items), as well as cases of less-than-ideal testaments.

This may result in a rather complicated case not only for the notary but also for the parties to the succession proceedings, including the surviving spouse, which may often snowball into many years of litigation.

It is therefore entirely advisable to be, as a precaution, in control of both the range of the community property (by means of a tailor-made modification agreement) and the rules of succession (such as by means of a properly conceptualized testament). In many ways, this will then ease the difficult situation of your beloved spouse in the moment they shall lose you as a life partner.