In recent years, corporate bonds have become a popular investment choice, largely because of their appealing annual yields of between 6% and 12%. This raises the question: If financial advisors recommend including bonds in conservative portfolios, why are corporate bonds also considered high-risk investments?

When investing in corporate bonds, remember that there are bonds, and there are bonds! Or more precisely, there are issuers and there are issuers because it depends on their ability to repay the borrowed funds and pay interest. This is about credit risk. The bond itself is innocent of this and investing in it is not in itself a bad thing.

In fact, a bond is a loan agreement between the issuer and investors, just taking a specific form of security. The principle is simple – the investor as the creditor lends money to the bond issuer as the borrower. The issuer issues a bond (security) in return, and must then return the borrowed money and pay interest to the investor within an agreed period of time.

When considering investing in corporate bonds, it is crucial to remain aware, stay vigilant, and diversify.

In the case of government bonds, bonds issued by banks or high-quality Czech and foreign bonds of large successful companies, often traded on a stock exchange, their issuers are financially strong, well managed, and the risk of default is very low in such cases (which, however, does not mean that it is non-existent).

However, in the last five years or so, the Czech market has been flooded with bonds issued by smaller or medium-sized companies for various business purposes, with different terms and often high credit risk. Some of them have also defaulted on their debts. From the investor's perspective, the terms of the investment and the quality of these borrowers need to be examined and weighed really carefully. To give you an idea, we currently have over 1,067 issued and outstanding Czech bonds issues (excluding government bonds) with a total value of approximately CZK 365 billion.

Problems in 2023: Junk bonds

The second half of 2023 already suggested a revival of interest in bonds. The volume of issued bonds exceeded CZK 96 billion. A significant portion of the bonds issued in 2023 were intended to refinance the 2019 and 2020 issues, i.e. to "roll over" the three- and four-year bonds into the next round. However, 2023 was not only a year of record volumes, but there were also problems and outstanding bonds. Most of the problematic issuers failed to manage their financial situation, overestimated their strengths or abilities, and this might have been exacerbated by the generally unfavourable economic situation.

In 2023, 34 bond issuers went bankrupt, mainly small, sub EUR 1 mio issuers (B&Bartoni, AMESTA, ExploR Capital, KTK CONSTRUCT and Concord Financial Invest, among others). This was the highest number of bankruptcies in the last ten years. In total, the bankrupt issuers issued bonds worth CZK 5.4 billion in the year in question, which is still a very low figure considering the total volume of bonds on the market.

As for major insolvencies, one can refer mainly to the Premiot Group, which faced financial difficulties and defaulted on its bonds in a volume of CZK 2–3 billion since the end of 2022, in which some 3,300 people invested, or the "bond phantom of Brno” – the Reality Investing group, which owes about CZK 640 million to more than 1,000 investors.

Eleven insolvency proceedings against bond issuers have been joined by the prosecuting attorney, which indicates potential criminal activity – investment fraud or unlawful asset stripping. In our opinion, a certain minor part of especially below-threshold issues may be essentially an investment fraud (a Ponzi scheme or pyramid scheme, where the company does not really do business and new investors finance the payout of those who came earlier).

Investment diversification: The key to minimising risk

One of the main lessons in light of the challenges of 2023 and beyond is the importance of diversifying your investment portfolio. Corporate bonds, and especially those in the real estate sector, may offer attractive return on investment, but they also present an increased risk. Diversification – spreading investments across different assets and sectors – is therefore a fundamental strategy for reducing risk and protecting invested capital.

Corporate bonds are inherently risky instruments that should form a minority in a conservative investor's portfolio. For example, according to the J&T Wealth Report 2023, the portfolios of Czech dollar millionaires contain 19% bond components – but these are high-quality, especially foreign bonds. Moreover, they do not bet on a few titles, but spread the risk of this asset class by investing in multiple companies or using bond ETFs (exchange traded funds), which themselves provide broad diversification.

In contrast, the Czech retail investor often places a substantial portion of their wealth in corporate bonds, and only in one or a few similar titles. Such an investor is overwhelmed by the vision of high returns and does not use professional advisors for their investments. They are then unable to rationally evaluate the specific credit risk themselves and instead of analysing the data, they invest more or less based on advertising, recommendations from distributors (motivated to sell their bonds) or friends (non-professionals). This puts the investor at an enormous risk of losing a major part of their assets, because in the event of financial difficulties and issuer insolvencies, there will be not much left to pay out usually unsecured creditors.

Bond selection: Information is the key

If you are willing to invest in corporate bonds, here is a quick tip for your first consideration and a basic resolution – who sells you the bond. Is it a renowned financing house or a ‘garage company’ or bond marketplace? Or does the issuer even distribute the bonds itself? And why is this important?

Renowned financial houses (for example J&T Bank, Wood & Co, Conseq, Cyrrus or other licenced securities dealers) will not distribute every bond. They choose issuers carefully, do financial analyses and define issue rules. The presence of a branded distributor is therefore a signal that the distributor, as a professional, considers the issue to be well prepared, and this is certainly a good starting point for you as an investor for further consideration.

Financial analysis of the issuer and the project is essential when selecting an investment. You should want to know who the borrower is, the company's anD its shareholders’ reputation, track record or commitment to the project.

At last year's investment conference, the approach of a major Czech investment bank to the selection of bonds for its portfolio was nicely summarised by representatives of Wood & Co. The issue should be directed to a specific project, i.e. there should be a clear intention as to where the proceeds of the bond issue are to be directed and the project should be relatively isolated from other assets of the issuer's group. It is this foundation (the project) that is crucial to the issuer’s ability to generate return; simply put – a bond is "the wrapping paper on a Christmas present", but we are interested in the present, not the "paper".

At the same time, a thorough financial analysis of the issuer and the project is essential when selecting an investment. You should want to know who the borrower is, the company's and its shareholders’ reputation, track record or commitment to the project. The primary consideration is also the project’s cash flow, i.e. whether it will realistically be sufficient to pay the coupon and repay the principal (this is Plan A). If cash flow is not strong enough, we address the likelihood of (re)financing at maturity (who, under what conditions) (this is plan B). Securing the bond with a surety or project assets comes last (this is Plan C).

10 Red Flags – How to recognize a risky bond?

Stricter conditions

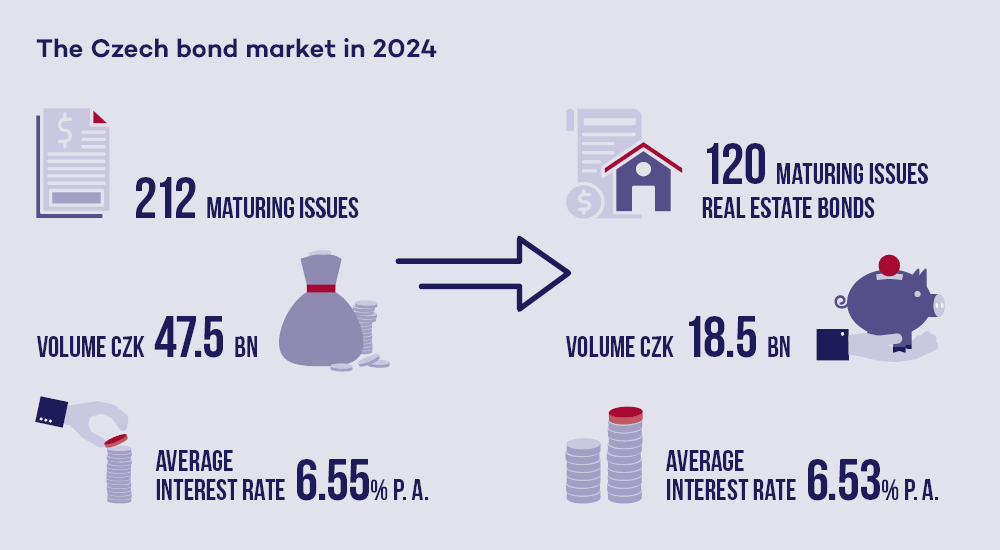

The Czech bond market started 2024 with further growth in the volume of bonds issued. This year, 212 issues will mature with a volume of approximately CZK 47.5 billion and an average interest rate of 6.55% p.a. The share of real estate bonds, i.e. those issued to finance real estate projects, is interesting. There will be about 120 issues maturing in 2024, with a volume of approximately CZK 18.5 billion and an average interest rate of 6.53% per annum.

January 2024 also brought a tightening of the conditions for the issue of sub-threshold bonds (i.e. in the volume of up to CZK 25 million). Now, in addition to the very terms of the bonds, the issuer must provide information on its website or directly to the investor about itself, persons in management, the beneficial owner of the issuer, its business management (including financial statements for the last two years) and the purpose of the bond issue. The aim is to give investors more information to assess the investment and credit risk of the issuer. Take advantage of it. We therefore recommend not relying on simplified or even distorted information from distributors and focusing on the terms of the investment itself and the accompanying documents.

In our view, however, this (certainly well-intentioned) step will not lead to a correction of the "dark zone" of sub-limit bonds because, in our experience, retail investors do not read the terms and conditions and accompanying documents very closely and rely on simplified and often distorted information provided by the distributors of such bonds. They are usually motivated to sell by high commissions (the issuer has to sell).

However, the terms of large issues remain unchanged. Each issuer must publish a 'prospectus', a detailed information document containing most of the information necessary for a responsible assessment of the investment. The prospectus is approved by the Czech National Bank (CNB), but the approval is only a confirmation that the prospectus contains all the necessary information. The CNB does not assess the credit risk or the quality of the issuer. Therefore, approval of the prospectus does not necessarily mean that the bond is of high quality.

We therefore recommend that you do not always rely on simplified or even distorted information from distributors and that you focus on the terms of the investment itself and the accompanying documents.