Employee stock ownership plans, or ESOPs, have become a popular incentive tool in recent years, particularly among startups and technology companies. However, taxation of these benefits remains a challenge for many employers. The rules have changed several times over the past year and a half, and in practice there is still uncertainty as to when and how tax should be paid. Let’s bring some clarity to the issue.

ESOPs allow key employees to share in the company’s success by receiving shares either free of charge or at a discounted price.

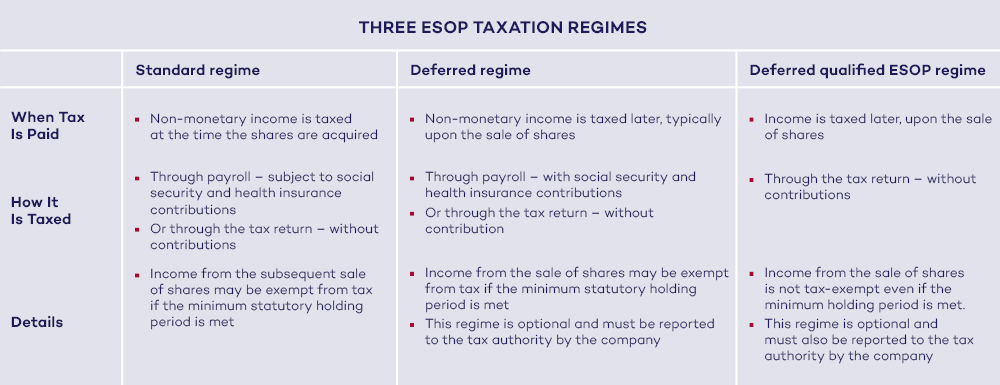

Employees may receive three types of income in connection with Employee Stock Ownership Plans (ESOPs). The first is non-monetary employment income, which arises when an employee acquires company shares – either outright or by exercising a previously agreed non-transferable option to acquire them – at no cost or below market value. This income is generally taxed as employment income. The second type of income is dividends, which are treated as capital income. The third type of income is income from the sale of shares, which the Income Taxes Act classifies as “other income”. In this article, we will focus on the taxation of non-monetary employment income, as this is where the most significant recent changes have occurred – and where we see the greatest number of practical questions.

The taxation of non-monetary income from ESOPs also depends on who provides the shares/ and who covers the related costs. If the shares are offered directly to employees by the Czech employer, or if the employer bears the costs of providing them (for example, by the parent company), the income is taxed as employment income – meaning it is processed through the company’s payroll system and is subject to social security and health insurance contributions.

On the other hand, if the shares are provided by a foreign parent company and the Czech employer does not bear the associated cost, the employee must report and tax the income via the tax return. In this case, no social security or health insurance contributions are due, but the responsibility for correct taxation rests with the employee.

An amendment is currently making its way through the legislative process that introduces a specific regime for qualified ESOPs and modifies (or adds to) the existing rules. For the sake of clarity, however, let’s first look at how the system has worked so far.

Tax Before Cash

Until the end of 2023, non-cash income was taxed at the moment the employee acquired the shares and could no longer lose them – for example, upon exercising options or upon vesting under Restricted Stock or Restricted Stock Unit plans.

In such cases, the company had to calculate the difference between the market value of the shares and any amount the employee had paid and then withhold tax and insurance contributions on that difference – reducing the employee’s net salary (“tax before cash”). As a result, employees often had to sell part of their shares in order to cover the tax, social security, and health insurance contributions.

For companies that are not publicly traded, this often also means complex valuations – a process that proved highly challenging for many of them.

Deferral of taxation

As of January 2024, the “no tax before cash” principle was introduced into the taxation of ESOPs. The law now allows taxation of shares acquired after 1 January 2024 to be deferred until the occurrence of a future “triggering event,” whichever comes first. Examples of such events include termination of employment, liquidation of the employer, or a change in the tax residence of either the employee or the employer (this condition is expected to be abolished from 2026). Other triggering events include the transfer of shares (e.g. sale or donation; note that a transfer between brokerage accounts without a change of ownership does not qualify), an exchange of shares resulting in a change in their total nominal value, or the passage of 10 years after acquisition (likely to be extended to 15 years from 2026).

The respective amendment to social security and health insurance legislation took effect on 1 July 2024.

In addition to deferring the point of taxation, the legislation introduced the possibility of reducing taxable income if the value of the shares decreases between acquisition and the moment of taxation. In such cases, dividends received – net of tax or any other consideration accrued up to the point of deferred taxation – must be taken into account.

However, this legislation did not otherwise alter the classification or method of taxation for ESOP income. Non-cash income remains treated as employment income, calculated as the difference between the market value of the shares at the time of acquisition and the price, if any, paid by the employee.

Nevertheless, proper reporting of deferred taxable income in payroll requires significant cooperation from the employee. They must inform the employer when they have sold the shares and at what price, as well as whether they have received dividends in the meantime, among other details. Although the law places a partial obligation on employees to provide this information, ensuring compliance can be challenging in practice. As a result, there have been calls for further amendments to the legislation.

Deferred regime notification

Dissatisfaction among many employers and representatives of the startup community led to another amendment to the legislation, which came into effect on 1 April 2025. This introduced the option of a deferred taxation regime – but to make use of it, employers must notify the tax administration.

From the moment employees acquire shares, the employer must submit a notification no later than the 20th day of the following month. For example, if an employee acquires shares in August, the notification must be filed by 20 September 2025. If the company fails to submit the notification on time, the income will be treated as taxable either in the month the employee acquired the shares (if processed through payroll) or as part of the employee’s annual tax return (if the employee handles the taxation personally).

This obligation applies not only to shares acquired after 1 April 2025, but also retroactively to shares acquired between 1 January 2024 and 31 March 2025. For these, use of the deferred taxation scheme had to be reported to the tax administration by 2 June 2025. If no notification was filed by this deadline, the income is considered taxable – either as part of the May 2025 payroll or as part of the employee’s 2025 tax return. For notification purposes, an optional form is available on the tax administration’s website.

Questions in practice

With the legislation effective from April, a number of practical issues have emerged that still need to be clarified in relation to ESOPs. For example, in April the General Financial Directorate confirmed that it remained possible to apply the rules in force until 31 December 2023 – meaning the value of the shares could either be taxed through payroll at the time of acquisition or reported by the employee as non-cash income in their 2024 tax return.

The Ministry of Health has agreed to a similar approach for income subject to payroll registration and social security and health insurance contributions. However, the Czech Social Security Administration has stated that it does not support this interpretation. This raises the question of whether, and how, retrospective corrections to payroll records should be made for income already recorded in 2024.

Other practical issues concern foreign companies that provide ESOPs to employees of their Czech branches. For instance, in the absence of a data box, submitting a notification by mail is impractical and carries the risk that the document may not arrive on time.

In general, the deferred tax regime is more advantageous for employees, while for employers it represents an additional administrative burden. Nevertheless, the decision on whether to apply the regime rests with the employer and depends on the company’s approach. It also remains unclear how situations will be handled where the company files the notification late without the employee – who is responsible for submitting the tax return – being aware of it.

The story doesn’t end there

The evolution of ESOP legislation is still ongoing. An amendment currently making its way through the legislative process specifically targets startups and will apply only to qualified ESOPs – as defined by law in relation to the company (startup), the participants (employees), and the plans themselves. Under this latest regime, income from ESOPs will also be taxed only at the time of the sale of shares and treated as “other income” under the Income Taxes Act in the employee’s tax return (no later than 15 years after the option is exercised or the shares are acquired). This means there will no longer be separate taxation of non-monetary employment income and income from the sale of shares.

Income from qualified ESOPs will not be subject to social security or health insurance contributions, and companies will not be required to report it through payroll records – only to file a notification with the tax authority by the deadline for submitting the monthly employer report.

However, under this latest scheme, income from the sale of shares cannot be exempt from taxation even if the statutory minimum holding period is met (three years for shares of joint stock company and five years for shares of a limited liability company). This differs from the “standard” and “deferred” schemes, where the exemption still applies.

In summary: the existing ESOP taxation regimes will remain in place alongside the newest one. Once the amendment is passed, there will be three distinct ESOP taxation regimes.