Women are becoming more actively involved in managing assets and addressing financial issues. A fifth of women decide on family wealth independently. They tend to invest more conservatively than men, taking sustainability into consideration. This was found in an extensive survey conducted by our law firm in cooperation with RSM CZ and the research agency Ipsos. The international partner of the project is UBS, the largest private bank in Europe.

Women get rich faster than men

Women are becoming more successful, more educated, more courageous and able to build wealth on their own. But women are also more likely to inherit assets. Statistically, they marry older men and on average live 6–7 years longer. Family wealth also passes on to them when assets are transferred from generation to generation. Globally, women's wealth is growing by USD 5 trillion a year, increasing at a faster pace than men's wealth. This is a global trend monitored by renowned consulting firms and also confirmed in the Czech environment by our NextŽeny study. We also asked whether women and men have any specific needs in terms of assets and finances. In cooperation with RSM CZ and the research agency Ipsos, we therefore asked the following questions about investments and assets in the survey.

Family assets as a partnership task

According to the survey data, a fifth of women and twice as many men make the decisions on financial and property matters for the entire household. Compared to the global figures from the UBS’ 2022 study, where the majority of married women admitted that they leave their financial decisions to their husbands, Czech women decide to a much greater extent on family assets by themselves. Traditional gender stereotypes and inequalities in the area of property are gradually disappearing, and 35% of people make decisions on these issues jointly in the family.

“More than ever, couples and families tend to approach financial and property issues as a partnership task in which both partners are actively involved and often work together to find the best solution for the family. However, we still perceive that men have greater self-confidence and tend to have the final say,” commented David Neveselý of HAVEL & PARTNERS.

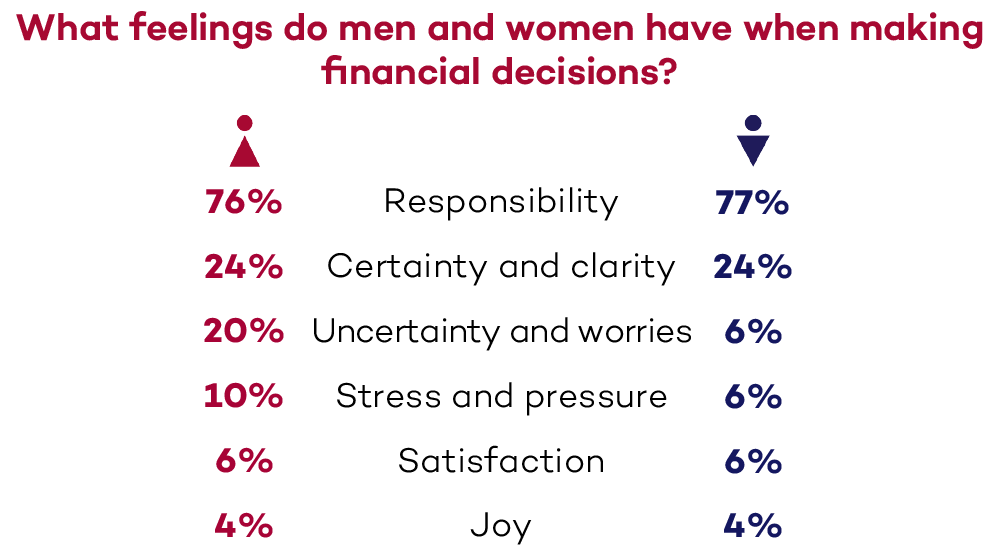

In fact, for people who make decisions about assets in the household jointly, nearly 70% of men said that they make the final decision. Only 45% of women had a final say. Women are also more likely to have mixed feelings when making decisions about investments and assets. A fifth of them said they were even insecure and felt worried. On the other hand, a quarter of women make decisions about their assets with confidence and clarity.

Women are more conservative, men diversify more

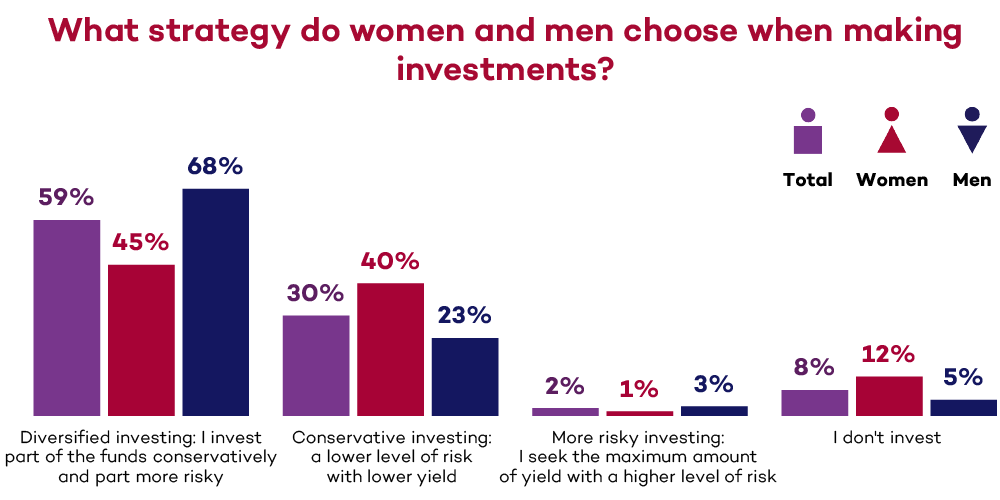

Men incline more to diversified investments, according to the NextŽeny survey. They are more likely to divide their assets between more conservative products and riskier, higher-yielding areas. They invest more than women in stocks, hedge funds, bonds or cryptocurrencies.

Women, on the other hand, are more likely than men to gravitate towards conservative investments and care about their security and stability. In addition to traditional savings accounts or pension savings and conservative investment funds, they also put a lot of faith in real estate. It is important for them to invest in line with their values. Compared to men, they therefore prefer to invest more in education or sustainability. Men, on the other hand, more often see prospects in the fields of technology and innovation, pharmaceuticals or automotive.

Advisory services on property and financial matters are used by 45% of people. Slightly more by women than men. “Women value professional advice more than men. Increasingly, women who are successful in business are turning to us with the need to plan and organise their asset management and invest wisely. With advisers, they not only address investment strategies and plans, but also mediate discussions and implement succession plans,” said Monika Marečková, managing partner of RSM CZ.

350 male and female investors

A total of 350 people participated in the survey, 143 of whom were women. Clients and business partners of HAVEL & PARTNERS and RSM Czech Republic, i.e., a group of affluent clients from the ranks of owners or co-owners of companies or top and middle management and people with assets reaching up to hundreds of millions of crowns, responded in the survey to questions about investments and assets. The survey also contributed to a good cause. For each completed questionnaire, HAVEL & PARTNERS contributed CZK 200 to the non-profit organization Dejme dětem šanci (Give Children a Chance), and RSM CZ supported the operation of the Paraple Centre with the same amount for each questionnaire.

NextŽeny around us

NextŽeny is a project focused on the global trend of shifting wealth to women, but also on women's power and growth, entrepreneurship, investing and networking. When we were thinking about who should be the face of NextŽeny, we immediately had a clear idea. All we had to do was look around. We have many female colleagues in our firm whose talent, enthusiasm, skills, energy and personal stories are extremely inspiring. Our successful female colleagues – from students to partners – who can be found in the photos, in the special magazine, in the video and on the NextŽeny website, have given the NextŽeny project a face.

Women Power on paper

The NextŽeny project also aims to motivate. And because it is important to show examples of successful women who can serve as role models and inspiration, a special magazine NextŽeny was created in cooperation with Premium Media Group. In addition to the survey results, it was entirely dedicated to inspiring women who are leaders in their fields across the world of business, education, investment, consulting or the non-profit sector, all proving that their success knows no boundaries. Their stories and the interviews with them thus gave a concrete face and content to previously abstract sociological figures.