Cryptocurrencies are an increasingly interesting asset even for investors who are not cyber enthusiasts. Yet there are still many questions and myths surrounding their taxation. Is the tax paid on the appreciation of cryptocurrencies or the profit? Does VAT apply? After all, we often hear that cryptocurrencies are tax exempt. Unfortunately, this is a rumour.

Czech law has not yet sufficiently responded to the existence and potential of cryptocurrencies. The legislation does not define the term cryptocurrency or any of its technical parameters – for example, there is no requirement that cryptocurrencies are created, stored or transferred in a blockchain or distributed ledger technology (DLT) environment, such as bitcoin, litecoin, ethereum or tether.

Kittens or bitcoin?

Czech legislation works with the term of a virtual asset only. If you agree with a customer that you will supply goods or services to them and will get paid with pictures of kittens sent via email, this will in fact create a virtual asset within the meaning of the only definition offered by Czech law in the Anti-Money Laundering Act. This Act sees the term as any electronically storable or transferable unit that can be used for exchange or investment and that is not subject to the Payment System Act.

The biggest pitfall in the taxation of cryptocurrencies, both in a positive and negative sense, is their market value and its changes and the lack of legal regulation.

Czech law has not yet looked closely at cryptocurrencies, but we certainly do not live in a legal vacuum or a cyber underworld. Cryptocurrencies in the Czech Republic are more and more attractive, even outside the groups of new technology enthusiasts. The value of bitcoin has increased by hundreds of percent over the last 5 years and, according to the opinion poll agency STEM/MARK, nearly a tenth of the population has purchased a cryptocurrency. Most people are aware that virtual currencies can be an interesting investment opportunity, yet there are still many questions surrounding this topic.

One of the most common issues we address with clients when investing in cryptocurrencies is taxation. We wish to dispel the common misconception that cryptocurrencies are not subject to taxation. If you want to invest or trade in cryptocurrencies, you need to be aware that you are taxed on the profits from their sale, and in certain circumstances you may be required to obtain a trade licence, pay social security and health insurance contributions, or become a VAT payer.

Put this down

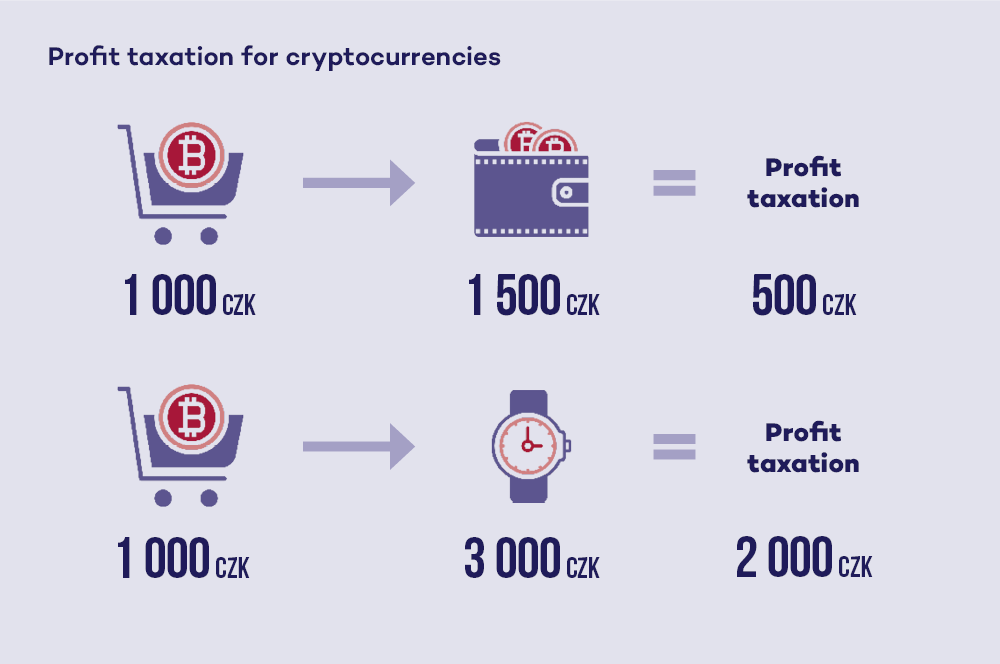

A house bought many years ago, the market value of which has increased many times since then, is not declared on the tax return just as the appreciation of the cryptocurrency itself. But what you definitely have to tax is the profit when you sell, buy or exchange something for the appreciated cryptocurrency. This can be illustrated in an example: you buy a cryptocurrency for CZK 1,000 and sell it for CZK 1,500, then you tax the profit of CZK 500. If you exchange a cryptocurrency bought for CZK 1,000 for a watch worth CZK 3,000, you tax the profit of CZK 2,000. This is based on the difference between the purchase price (not the current market price) of the cryptocurrency and its selling price, or the price of the consideration received.

In the Czech Republic, taxes are declared and paid in Czech crowns. However, the price of cryptocurrencies is usually only identifiable in foreign currency, typically euros or US dollars. For taxation purposes, everything must therefore be converted into Czech crowns, not just at any exchange rate, but at the rate set by the tax laws. If you keep accounting records, you must deal with foreign exchange gains/losses in terms of accounting and taxation.

As taxpayers, you must also be able to prove to the tax authority that you have taxed everything properly. In addition, the tax authority may require information from persons who publicly allow purchases using cryptocurrencies about buyers who have taken advantage of this option. Likewise, it may find out that your bank account has been credited with funds from a crypto exchange, cryptocurrency exchange office or e-wallet provider. It can then obtain more information (for now rather in theory) directly from such sources. A little effort and careful record-keeping will therefore definitely help you avoid any difficulties.

Gains and losses

You can also appreciate your crypto assets by staking. This works similarly to an interest-bearing term deposit in a bank. In short, you deposit a certain amount of cryptocurrency somewhere, commit to not deal with it for a certain amount of time, and get rewarded with additional units of cryptocurrency. As a result, this can also be a source of taxable income in the case of cryptocurrencies. However, unlike cryptocurrency mining, the tax authorities have not yet provided a clear statement on the taxation of such assets.

One needs to be careful about taxing any profits in speculative on-chain trading in cryptocurrencies, especially if you use automated applications that buy and sell essentially on their own and at lightning speed according to the predefined parameters. Again, the big issues in such cases include identifying and substantiating the costs of such trades and then reporting any profit to be taxed. Even here, you cannot do without at least basic record-keeping to determine the purchase price of the cryptocurrencies sold.

At the end of the year, it is then always necessary to determine the amount of total available income from cryptocurrency trades and the amount of expenditure spent on this income (the number of units of cryptocurrency sold and their purchase price). Otherwise, there is a risk that you may only be able to deduct the demonstrable initial cost at the start of trading and fees (if any) from the final trading income for tax purposes. In addition, if you are not a sole trader, the trades did not work out and you ended up in a loss, you cannot deduct this loss from income from other sources where you may have done better.

Czech law also does not yet allow virtual assets to be treated for tax purposes in the same way as securities or shares in companies, the transfer of which is exempt from income tax for an individual (and in the case of shares also for the parent company) under certain conditions. However, virtual assets carrying a right to a certain benefit or to a share in the profit of a company are not yet subject to such exemption.

Cryptocurrencies and VAT

From the perspective of private law, cryptocurrency is an intangible movable thing, similar to the electronic picture of a kitten referred to above. However, to make things less simple, a transfer of cryptocurrency is considered a supply of services for VAT purposes. As a result, when a VAT payer buys electronics from another taxpayer using bitcoins, he or she basically pays the price with a service in return. The seller then declares and pays VAT in the same way as if the price had been paid in cash. However, the crucial difference is that the buyer guarantees, under certain conditions, that the seller will properly declare and pay VAT on that sale.

Last but not least, it should also be borne in mind that some methods of dealing with cryptocurrencies give rise not only to the obligation to obtain a trade licence, but also inevitably to make compulsory social and health insurance contributions and, potentially, to pay VAT, not to mention the obligation to identify and check clients as part of anti-money laundering measures. Typically, these cases are outside the scope of your own asset management, i.e. when you trade or otherwise deal with other owners’ cryptocurrencies for a fee or when you broker such transactions.

The fact whether or not such an activity will in time also give rise to a VAT payer status depends on the content of the activity and the type of the virtual asset (a special case is typically NFTs). Only transactions that one succeeds to defend before the tax authority as ‘objective financial activities’ are exempt from VAT under certain conditions (but without the right to deduct), and if the provider does not carry out any other, non-exempt gainful activity, they will not become a VAT payer either.