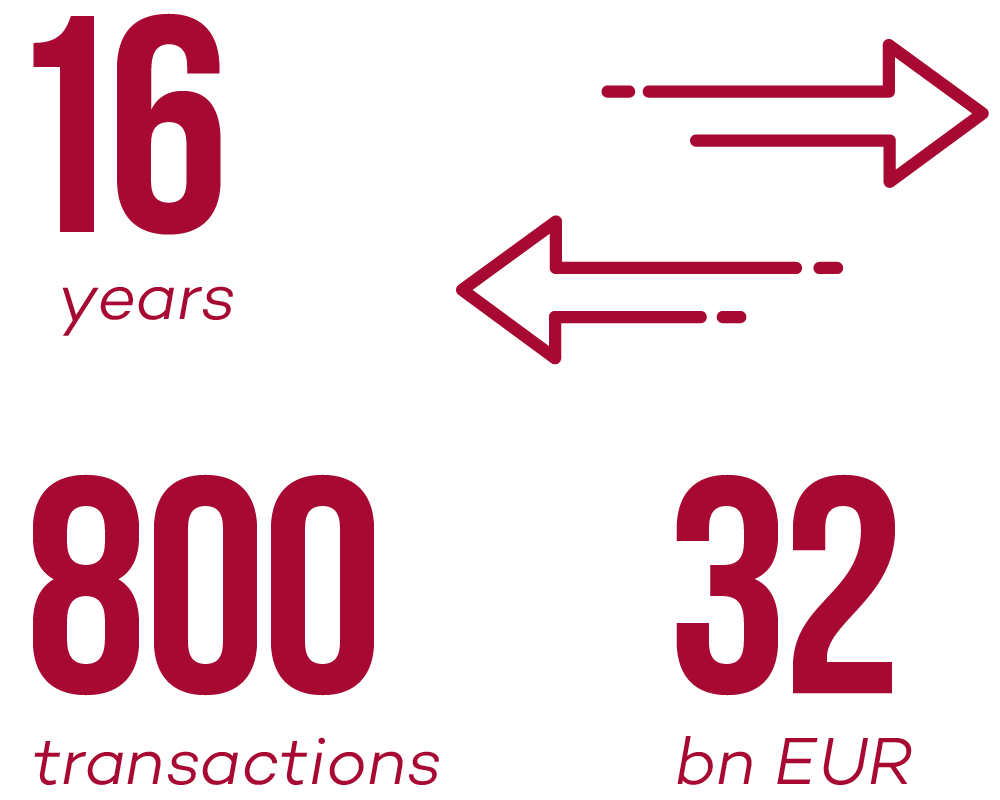

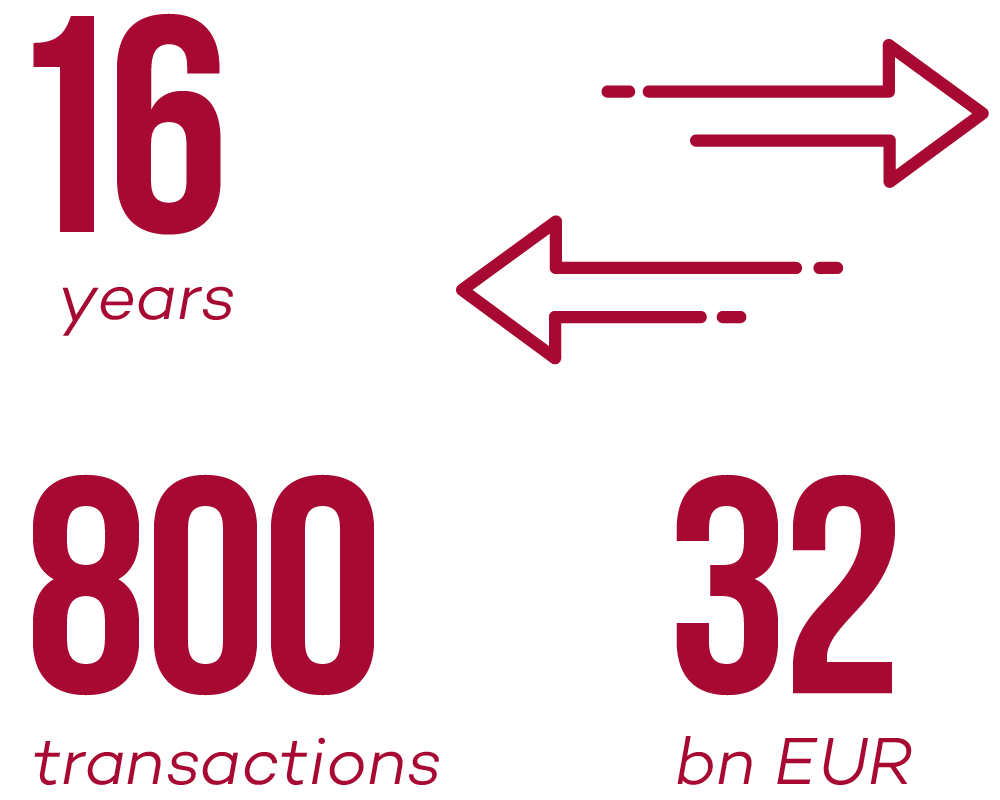

Over the past 16 years, we have been involved in completing over 800 transactions, not only in mergers, acquisitions, divestments, and restructurings. Their total value exceeds EUR 32 billion. Here is an overview of the major ones in the recent period.

GENESIS PRIVATE EQUITY FUND III

Our team represented Genesis Private Equity Fund III of the Genesis Capital Group in the sale of an 85.9% stake in QUINTA-ANALYTICA. The latter is a major Czech provider of research and regulatory services to the pharmaceutical, biotechnology and generic pharmaceuticals industries. The stake was newly acquired by LVA Holding from the portfolio of BBA Capital Partners.

Legal advice in connection with the transaction was provided by partner Václav Audes, senior associate Veronika Filipová, and legal assistant Filip Pavlík.

Genesis Capital has been cooperating with HAVEL & PARTNERS for a long time, and in 2016 we also provided comprehensive legal services during the company’s entry into QUINTA-ANALYTICA. The then share purchase was a prime example of how to address a succession. The fund became the majority owner of the company and kick-started its growth strategy.

SEALL

Partner Jan Koval and senior associate Veronika Filipová provided comprehensive legal support to the owners of SEALL, who sold their stake in this leading Czech company manufacturing and selling hydraulic, pneumatic and sealing components to Rubix Czech.

The new owner belongs to the group of the European leader in the distribution of industrial consumables, Rubix. It is the only distributor with a pan-European presence that deals with all the premium brands of manufacturers in the industry. The acquisition is aimed at increasing the group’s market share in the fluid technology market and expanding the services provided to existing customers.

ČEMAT

Michelin, a major global tyre manufacturer and distributor, has acquired ČEMAT in the Czech Republic and Slovakia. The company has been active on the market for 25 years and is one of the largest suppliers of accessories for handling, construction and agricultural machinery. It also offers maintenance services for such machinery.

We provided comprehensive legal advice to the owner of ČEMAT on the sale of his 100% stake in the company in both countries, which was handled by the firm’s partners Jan Koval and Petr Dohnal, as well as senior associate Ivo Skolil. This was a significant acquisition for Michelin, which will strengthen the company’s position on the Czech and Slovak markets and expand its operations in Central Europe.

PTÁČEK KOUPELNY

For the Ptáček velkoobchod group, which owns a wide network of stores selling bathroom fittings, sanitary ware and heating equipment, our team worked on several transactions aimed at acquiring shares in the companies owning industrial and retail parks in Prague and České Budějovice.

We advised the client on the acquisition of a share in Průmyslový park Harfa and also acted as legal adviser on the acquisition of shares in ProStorage and Retail Park CAR CB. Partner Jan Koval and associate Josef Bouchal provided comprehensive M&A advice to the client. The team also included tax advisor Martin Bureš, who handled the tax aspects of the acquisitions.

Mylan

For the global pharmaceutical group Mylan, our office in Slovakia provided comprehensive legal support in the acquisition of assets from the local legal structure of another major global pharmaceutical group, Aspen.

Partner Václav Audes and senior associate Tomáš Navrátil were involved in the transaction. Mylan is a global pharmaceutical company with a portfolio of more than 7,500 pharmaceutical products worldwide and is one of the world's largest producers of active pharmacological substances.

KLEIN AUTOMOTIVE

Our M&A experts – partner Václav Audes, managing associate Silvie Király and legal assistant Filip Pavlík – handled the sale of a 100% stake in KLEIN automotive for our clients. The company, which until now had Czech owners through the investment fund K-Invest, was acquired by the global company MAGNA Automotive Europe.

KLEIN automotive, a Czech company with a manufacturing plant in Štíty, specialises in the manufacture and supply of car bodies and other automotive components and employs around 500 people. The Canada-based MAGNA Group is one of the world’s largest automotive suppliers.

The acquisition was the largest investment in the industry in the Czech Republic in 2021 and had to be approved by the Office for the Protection of Competition.

HERKUL

In a major acquisition in the construction sector, AVE CZ odpadové hospodářství became the new owner of the construction company HERKUL. Our firm participated in this transaction as a representative of the owners of HERKUL – their legal advisors were partner Jan Koval, managing associate Robert Porubský, and senior associate Ivo Skolil.

HERKUL is primarily engaged in transport and civil engineering construction, and through this transaction AVE CZ took control of a major player in the field of civil engineering works with a turnover of around CZK 1 billion, which is currently a leading supplier of linear constructions, especially in the Ústí and Central Bohemia regions.

SMART COMP

Our team consisting of partner Václav Audes, senior associate Juraj Petro and legal assistant Filip Pavlík represented the majority owners of SMART Comp, who sold their shares to Nej.cz, in a major transaction on the Czech telecommunications market. Both companies are major Internet providers.

SMART Comp has been operating since 1998 and, in addition to Internet access, offers customers in the Czech Republic and Slovakia mobile services and Kuki internet television. Nej.cz provides Internet to more than 200,000 households and 10,000 companies. The transaction followed a series of mergers with six other telecommunications companies, which Nej.cz completed in 2021.

CREDO VENTURES / EARLYBIRD DIGITAL EAST fund

We acted as legal advisors in one of the largest venture capital investments in Slovakia. In successfully completing the investment round (Series B), we provided legal services to investors Credo Ventures and Earlybird Digital East Fund, as well as to Slovak start-up Photoneo itself, which raised a total of USD 21 million in new capital, or nearly half a billion Czech crowns.

The transaction was led by M&A and venture capital specialists - partner Václav Audes, senior associate Tomáš Navrátil, associate Ivana Gajdošová, and junior associate Kristína Očenášová.

Photoneo specialises in research and development activities in the field of 3D sensing technology and vision-guided robots, and also focuses on new comprehensive solutions for fully automated distribution centres.

CF GROUP

In connection with an equity investment by the Czech investor Pale Fire Capital, the Bratislava office team represented CF Group, which operates a chain of modern food concepts, including Regal Burger restaurants. The investment in CF Group amounted to EUR 2.3 million and also includes the acquisition of a stake in Banh-mi-Ba, where CF Group acquired a majority stake in this Vietnamese restaurant chain.

HAVEL & PARTNERS partner Ondřej Majer and senior associate Tomáš Navrátil provided comprehensive legal advice to CF Group on the investment and acquisition. CF Group will use the new capital to strengthen marketing, research, development, recruitment and overall growth of the group in Slovakia, the Czech Republic and most recently in Abu Dhabi.

GENERATION CAPITAL / HELIOS FUND

Our law firm advised foreign investors Generation Capital and Helios Fund on the provision of an equity investment at the level of the Polish parent company GREENWAY HOLDING, which through its subsidiaries operates a network of charging stations in Slovakia and Poland.

The legal advice, provided by partner Jan Koval, managing associate Robert Porubský, senior associate Elena Jarolímková, and associates Ivana Gajdošová and Zuzana Hargašová, included due diligence, negotiation of transaction documentation, including setting up relations with new investors, as well as comprehensive advice related to the financing of the investment from the European Investment Bank’s funds.

DANUCEM SLOVENSKO

In several separate transactions involving the acquisition of industrial and manufacturing sites in Slovakia, the firm’s Bratislava team assisted our client Danucem Slovensko with the preparation of the transaction documentation as well as with detailed legal due diligence, particularly in the area of real estate law.

The legal team included partner Ondřej Majer, associate Ivana Gajdošová, and associate Peter Košecký.

Danucem belongs to the parent CRH Group, which ranks among the top leaders in the supply of building materials. With thousands of employees and partners, it helps build roads and residential and commercial buildings around the world. Their materials have been used for projects such as the Messner Mountain Museum in Italy, the Atlanta soccer stadium, and Panorama City in Bratislava.