The year 2025 brings the most significant changes to value added tax for businesses in recent years. The changes not only affect VAT payers, but also companies that are yet to become VAT payers. Do you fall into this category? We have put together a list of tax news you should not miss.

The changes affect VAT registration, deduction entitlements and new rules on real estate.

With the arrival of the new year, there have been extensive changes in the area of taxes brought about by the amendment to the VAT Act. This brings with it fundamental changes in the tax practice of companies. The amendment requires closer monitoring of turnover, overdue payables and deadlines for claiming deductions.

Changes in the VAT payer registrations

The previous practice of calculating turnover for VAT registration has changed significantly since January. If you were not a VAT payer, you had to monitor whether your turnover exceeded CZK 2 million for 12 consecutive months. If you exceeded the limit, you had to apply for registration by the 15th day of the following month and became a taxpayer from the 1st day of the second month following the month in which you exceeded the limit.

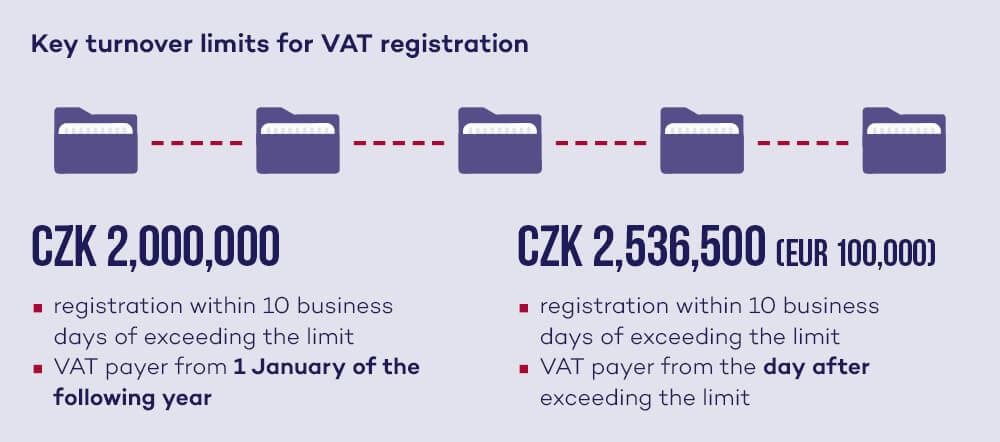

Now, however, besides the need to monitor a turnover of CZK 2 million, a turnover of CZK 2,536,500 also has to be tracked. This is a limit of EUR 100,000 based on EU law. Both turnovers are always calculated on a calendar year basis, not for any 12 consecutive months. And there are basically two new scenarios. If you exceed the turnover of CZK 2 million but do not reach the higher limit of CZK 2,536,500, you do not become a VAT payer immediately, but only from 1 January of the following year. However, you can voluntarily register sooner.

However, if your turnover exceeds CZK 2,536,500 (i.e. the threshold of EUR 100,000) by the end of the year, you must register immediately, i.e. on the day after your turnover is exceeded. You must do so within 10 business days.

Let’s use an example: If your company reaches a turnover of CZK 2,200,000 on 10 February 2025, you must file the registration within 10 business days, i.e. by 24 February 2025, but you will only become a VAT payer from 1 January 2026. However, if your turnover exceeds CZK 2,600,000, i.e. the higher threshold, on 6 June 2025, you will become a VAT payer on 7 June 2025 and must submit a supplementary registration by 20 June 2025.

Scheme for small businesses

If you plan to trade in other EU Member States, the amendment has introduced the possibility for small businesses to register in the scheme. You can do this as long as you have not exceeded a total turnover of CZK 2,536,500 in the Czech Republic and the EU. The aim is to level the playing field and reduce the administrative burden of having to register for VAT in another EU Member State.

For you as a Czech entrepreneur, this means that if in the future you are obliged to register for VAT in another EU Member State (e.g. due to retail sale of goods or services of a lower value in that state), you can voluntarily pre-register through the Czech tax office under the small businesses scheme and thus avoid the standard VAT registration.

However, you will need to monitor and report your turnover regularly. All transactions up to the given turnover will be treated as exempt transactions without any entitlement to deduction. Keep in mind that currently, the turnover for the small business scheme is not the same in all states, so we always recommend checking the turnover and conditions applicable to the new scheme in a particular country before registering for it.

Tax base corrections

The amendment also changes the rules for tax base corrections. Until the end of 2024, you had 3 years to correct the VAT declared and paid, but this has now been extended to 7 years (however, 3 years still apply for advance VAT payments). This is a response to a common supplier practice where product warranties often exceed 3 years.

Corrections to the tax base will have to be made even if you cease to be a VAT payer within 7 years of the transaction (or 3 years from the advance VAT payment). The correction is made in an additional tax return and subsequent VAT ledger statement for the last tax period before the cancellation of registration.

Reduction of the period for claiming the deduction

On the other hand, a rather negative change for taxpayers is the new period for claiming the deduction, which was shortened from three to two years. This two-year period starts to run from the end of the calendar year in which the deduction could be claimed for the first time. This means that if, for example, you buy goods and receive a tax receipt in February 2025, you may claim the deduction in your VAT return for the December 2027 tax year at the latest.

According to the explanatory memorandum, in almost 99% of cases, taxpayers claim the deduction in the first or second tax return in which it may be claimed. According to the authors of the VAT amendment, the shortening of the period is not to affect the taxpayers in any significant manner. On the other hand, the tax administrator will have more time to check the tax and make additional tax assessment.

Correction of deductions after cancellation of VAT registration

As with the correction of the tax base, the obligation to correct the VAT deduction after the cancellation of VAT registration is also maintained if you, as a taxpayer, were obliged to correct the deduction. The correction is again made in an additional tax return and subsequent VAT ledger statement for the last tax period before the cancellation of registration.

VAT deduction for overdue payables

The new regulation aims to motivate debtors to meet their obligations on time. Customers will need to refund the VAT deduction for any payables that remain unpaid 6 months after their due date. If the taxpayers subsequently fulfil their liability, they will be entitled to claim the VAT deduction again. This new obligation will entail additional administration, as you as payers will have to keep track of the above deadline.

Taxation of real estate

Further changes in the VAT area will take place from 1 July 2025, and will mainly concern real estate. From the effective date of these changes, VAT will only be levied on buildings on their first supply or on their first supply after a substantial change (renovation and reconstruction), and only if the sale takes place before the 23rd month following the month of completion of the construction. After this period, the sale of the buildings will be exempt from VAT.

This relates to the lowering of the threshold of what is and what is not a substantial change to the structure. The new regulation implies it includes any construction modifications that increase the value of the building as long as the cost of such modification exceeds 30% of the sale price. This means that we are more likely to see output VAT applied to reconstructed buildings.

VAT deduction for luxury cars

Gradual changes will also occur in other areas. For example, from 1 January 2027, there will be changes affecting deductions for luxury cars. Currently, the maximum limit for the VAT deduction for the purchase of a car is CZK 420,000. This corresponds to the input VAT at a rate of 21% calculated on the tax base of CZK 2,000,000. Therefore, if you as an entrepreneur buy a car for more than CZK 2,000,000 excluding VAT, you will be able to claim a deduction only up to CZK 420,000 and any VAT paid in excess of this amount will remain your expense.

This non-deductible VAT represents a significant financial burden for entrepreneurs. After consultation with the VAT Committee, the legislator also concluded that this regulation should not be permanent and proposes to abolish it after three years, i.e. as of 1 January 2027.