How can one safeguard against fragmentation of their assets due to family disputes or failed marriages? How can accumulated wealth be passed on to future generations? Or how can one secure a lifetime annuity? These are questions many successful entrepreneurs ponder. The most effective solution is an endowment fund.

Endowment funds serve as a way to simply and cheaply protect your wealth, ensuring that it doesn’t fall into the wrong hands.

Decades of hard work, business development and expansion – with the ultimate goal of providing for yourself and your descendants for the rest of their lives. However, according to an AMBIS College survey of Czech dollar millionaires, four in five of them want to pass the company on to their children, but half of them have no specific succession plan.

That is a huge risk. Imagine a successful businessman who is married and has two children. In the event of his sudden death, if he has failed to execute a testament and to modify the statutory regime of his community property, his assets will be divided as provided for by statutory law in the absence of any other arrangement. Half of the community property goes to his spouse and the other half is divided between his spouse and his children. However, such rule may not necessarily fulfil most people’s wishes.

When the property is divided under statutory law, there is a risk that it will be further fragmented. For example, if the widowed spouse marries again or has a new partner, or if the marriage of one of the children fails, a large part of the original assets may end up outside the original family. After all, a Deloitte study surveying entrepreneurs across Europe found out that changes in family relationships were the biggest threat to business.

What happens when...

Taken to the extreme, there is another concern that no one wants to even think about. What happens when both parents tragically die at the same time? Who will take care of the children and other family members, who will pass on all the information, ideas, relationships? The good news is, you can prepare for such risks.

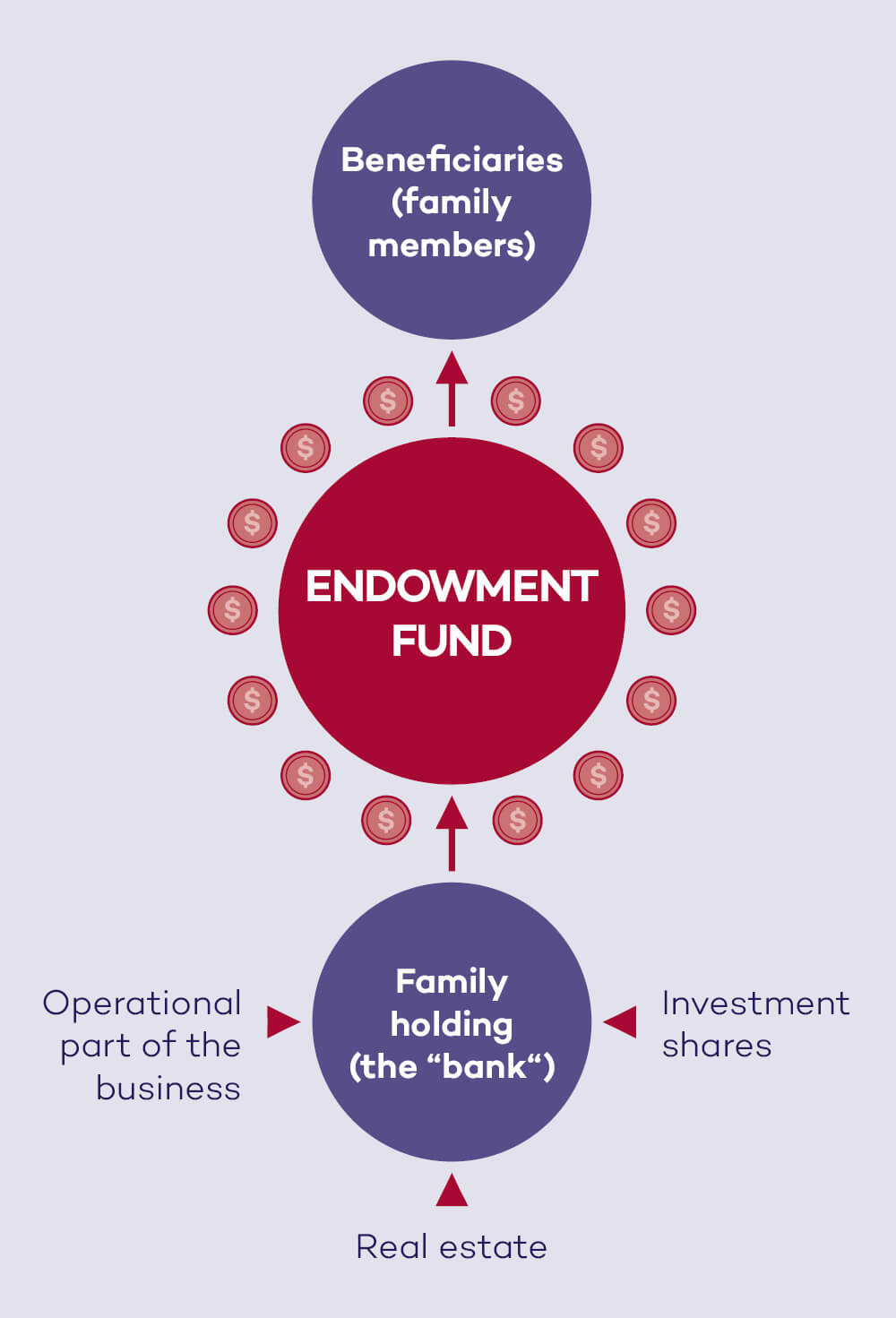

For ten years, Czech law has been offering effective options to do so. In 2014, the new Civil Code introduced several tools to manage your property. Although each family’s ideas and situation are individual, we have long recommended the combination of a family holding and an endowment fund, which has been tried and tested abroad. These two instruments can be flexibly adapted to the needs and wishes of family members, with the advantage of maintaining a functional family business. The endowment fund is a safety net for the family assets, while the family holding becomes a kind of small private bank.

After parking a family business within a holding company, it can sometimes be advantageous to split it into two parts. The first part will continue to develop the primary business, while the second part will consist of non-operational assets, most often the company’s real estate. Through dividends, money flows into such a family bank, which can then be reinvested tax-free or used for drawing an annuity. Combined with prudent international risk distribution methods, this creates a robust safety net to overcome various family and business risks.

Family constitution and fiduciary management

Everything is then overseen by a family foundation in the form of a trust, endowment fund, or Czech trust fund. Its founding document resembles a family constitution – as its creator, you can incorporate in it the principles and values you wish to preserve for future generations. You can also set rules for drawing money and transferring assets.

Professional fiduciary trustees from HAVEL & PARTNERS and ONE FAMILY OFFICE, with their highly experienced team, can also assist with overseeing compliance with such rules, as they have ample time and extensive expertise in long-term asset management.

The rules that you set forth should always be the result of a discussion between the founding generation and the successors as their views may differ. There is nothing worse for children than being given a few hundred million and being pushed by their parents into getting involved in a business that is not their cup of tea. We are aware of several cases where this has gone very badly, as a result of one hasty wedding.

We therefore recommend to our clients a solution using endowment funds, which allow you to plan for all scenarios. For example, it may be stipulated that after your death, your children do not become owners outright, but the board will pay them money to secure them a decent life, pay for their education or buy starter homes. As your estate is not distributed all at once, the current assets will support the generations to come, with some funds left for philanthropy. Rules can also be set to prevent certain people outside the family circle from becoming shareholders.

Your children do not have to stand passively by, though. They can decide, for example, about some part of the investments. There are many possibilities and combinations. Moreover, managing family wealth is usually much more attractive to the successor generation than managing the original business, to which they have no connection. Not everyone is attracted by the chance to manage a factory, for example.

The basic piece of advice is to start addressing these issues early. It is quite easy to reconcile your visions and ideas when you have a happy marriage. If your relationship is in crisis, the arrangement is reached in a completely different manner. In addition, no one wants to think about various tragic events and the impacts on the family. Dealing with these matters in advance and with a calm and cool head will definitely save your family a lot of difficult moments in the future.

The founder’s will that cannot be bypassed

The endowment fund must comply with the principles enshrined in the “family constitution” even after the founder’s death. When establishing an endowment fund, clients often want to prevent their children from selling the company at the first opportunity. On the other hand, they don’t want to prevent them from exiting the company forever. We often incorporate such measures in “family constitutions”. You can, for example, condition the sale on an external valuation and a threshold below which the sale will be prohibited.

An endowment fund always combines permanence and flexibility. The founder’s will is immutable. However, within the rules laid down by the founder, changes can be easily executed at a notary. After the founder’s death, these are decided by a board made up of family members and a professional trustee – but always complying with the rules set by the founder.

This flexibility is one of the advantages of a family foundation compared to a trust, a form often considered by wealthy Czechs. The thing is that trusts are generally much more difficult to control. If you go for a trust, your assets are factually locked in, and you can only change the rules of the game later with the court’s permission. The trust cannot be headed by its settlor or anyone else who uses funds from it. We therefore use trusts primarily where the client wants to preserve things, without allowing any changes.

In this practice area, we have been active since 2008, working for one third of the wealthiest Czechs and Slovaks. We have created hundreds of trusts and endowment funds that manage more than CZK 180 billion.

Czech legal solutions and foreign accounts

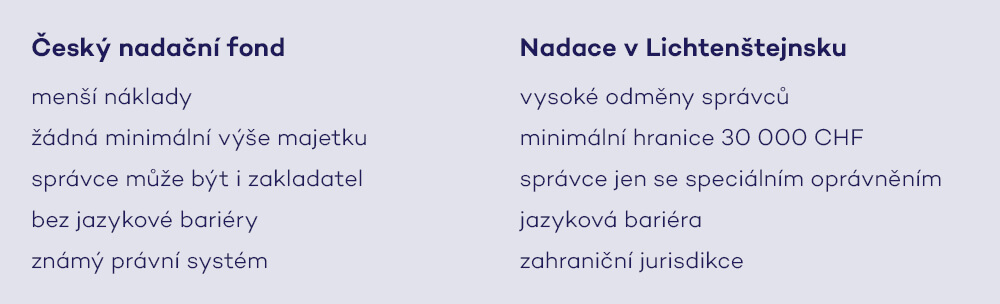

Another option, often promoted among wealthy Czechs, is to set up a Liechtenstein-based foundation. However, compared to the Czech solution, this option has several disadvantages.

Liechtenstein has a rigid system not allowing a Czech client to manage the foundation on his or her own. Moreover, the client must overcome a language barrier and cannot use global consulting services. The Liechtenstein market is occupied by several smaller law, accounting, and consulting firms. They charge high fees.

Conversely, opting for a Czech solution is more cost-effective and simpler. Establishing endowment funds in the Czech Republic faces almost no barriers. Unlike foreign regulations, there is no minimum asset requirement. Additionally, the law imposes minimal demands on trustees; the founder himself/herself can efficiently govern a domestic foundation and manage foreign assets within a Czech fund. This can be done while leveraging the robust services of renowned foreign private banking institutions, including Swiss banks.

Endowment fund as a lasting legacy

If you take the ranking of the wealthiest Czech families, practically every one of them is engaged in charity. It’s not just about one-off donations. Often their foundations focus on and systematically support selected areas because they are close to them, be it education for children from disadvantaged backgrounds, palliative care or other fields.

Family philanthropy may be yet another function of the endowment fund. Long-term support for promising Czech scientists or athletes or anything else close to the founder and his family can last for generations to come.